What is CASH(k)?

John K. McGill, MBA, CPA, JD, and Jason Arnold, QKA

For more on this topic, go to www.dentaleconomics.com and search using the following key words: retirement planning, salary deferral, profit sharing, John K. McGill, MBA, CPA, JD.

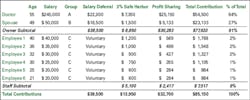

The Class Allocation Safe Harbor 401(k) or “CASH(k)” is a type of 401(k) designed to maximize contributions for doctors and certain targeted groups, while keeping overall staff costs to a minimum. Through a combination of employee salary deferrals, safe harbor, and profit sharing contributions, doctors can often receive the maximum allocation limit of $49,000, or $54,500 if age 50 or older, with only 5% of pay contribution to staff.

The CASH(k) first allocates a safe harbor contribution equal to 3% of pay to all eligible participants. This contribution allows the plan to avoid traditional nondiscrimination 401(k) testing that would normally be required. Doctors then can contribute the maximum salary deferral without regard to the salary deferrals contributed by staff.

The salary deferral limit for 2011 is $16,500, or $22,000 if age 50 or older. A Safe Harbor 401(k) must provide employees with a written notice every year (30 to 60 days prior to the start of the plan year). Safe harbor contributions cannot be subject to a vesting schedule, like profit sharing contributions, and are 100% vested at all times.

Participants are then grouped into different classes for purposes of determining the allocation of employer profit sharing contributions. Contributions are determined separately for each class, targeting doctors and key employees (who are generally older than the other employees), and then tested to ensure benefits for each class are comparable. Profit sharing contributions can be subject to a vesting schedule for a period of up to six years.

The table illustrates how a doctor and spouse can receive up to 91% of the total allocation with a CASH(k) design. Not only are the contribution allocation percentages attractive, but they also provide an employer with maximum flexibility. The profit sharing contribution is discretionary and can be changed from year to year, based on the employer’s ability to fund. The only required contribution to the plan annually is the 3% safe harbor.

Who should consider a CASH(k)? Doctors who have at least a five-year advantage relative to the average age of their staff, or group practices who wish to make different contribution amounts for each doctor, and would like to allocate a larger share of the contribution on their behalf, while minimizing staff funding costs.

Jason Arnold provides retirement plan design and administration through PenSys, Inc., (888) 440-6401, an affiliate of McGill & Hill Group, a one-stop resource for tax/business planning, practice transition, legal, retirement plan administration, CPA, and investment advisory services. John McGill provides tax and business planning exclusively for the dental profession and also publishes “The McGill Advisory” newsletter through John K. McGill & Company, Inc., member of the McGill & Hill Group, LLC. For information on webinars presented by the firm, visit www.mcgillhillgroup.com/webinars.asp.