Transitions Roundtable

We ask two experts the same question to give you two different answers on a complex issue

QUESTION

“I plan on selling my practice and retiring in two years. My plan is to find a new graduate, hire him or her as an associate, and complete the sale after I see the person is the right successor. My dental supply rep says the first step should be to get my practice appraised, but I want to wait until I am ready to sell. What do you advise?”

by Guy Jaffe, MBA

An appraisal should be done now which will serve as the baseline value. A second appraisal should be done immediately before the associate purchases the practice by the original appraiser using the same methodology.

By doing two appraisals, the associate will not feel resentful having helped in creating the additional $400,000 ($600,000 to $1 million) in revenues during his two-year associateship.

The results of the two appraisals are as follows:

BASELINE EVALUATION: (Done at the beginning of the associateship, two years ago)

Gross Receipts: $600,000

Appraised Value $400,000

Hard Assets $100,000

Goodwill $300,000

EVALUATION IMMEDIATELY PRIOR TO SALE:

Gross Receipts $1,000,000

Appraised Value $ 670,000

Hard Assets $ 150,000

Goodwill $ 520,000

The value of the Hard Assets increased by $50,000 which went to purchase a newly equipped operatory for the associate at the time he began. The entire cost of the new equipment was adjusted and passed through to the associate dentist.

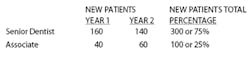

The Goodwill was adjusted based upon how many new patients came to the practice to see the practice or the senior dentist and how many came to see the associate during the two years of the associateship:

The adjustment of Goodwill was based upon how many new patients each party generated:

The advice to do an initial appraisal was wise.

Guy Jaffe, MBA, is a principal of ADS Midwest and past president of American Dental Sales. He provides brokerage, appraisal, and consulting services in St. Louis, Columbia, and Cape Girardeau, Mo., and central and southern Illinois. He can be reached at (800) 221-6927 or at [email protected]">[email protected].

by Dr. Gene Heller

Your dental supply rep is correct. Part of the valuation process dictates whether the practice can support two dentists during the transition phase. If the owner/senior dentist enters into both an employment agreement and a letter of intent containing the agreed price for the practice before the associate begins employment, there is a significantly higher probability the buyer will in fact successfully close on the practice sale instead of arguing about the sale price when the senior doctor wants to slow down and/or retire. If the sale fails to materialize, the senior doctor faces a postponement of plans and/or starting over in the process.

Long before a possible retirement sale, there are many other reasons every doctor should have a current and regularly updated valuation. A practice valuation tells the business owner what his/her probably largest asset is worth, both to their estate, and in the marketplace and aids retirement planning. As with any large or small business listed on one of the stock exchanges, this should be an ongoing process.

Another by-product of a well done practice evaluation and assessment is a comparison of how that practice compares to industry norms, both from a practice management and a business value perspective. While doctors are acutely aware of the day-to-day cash flow and profit generated by a dental practice, most seem to forget that a big part of the business benefit of owning a practice is the build-up of equity over the years of ownership. This value and equity must: 1) be recognized, 2) be protected, and 3) wherever possible enhanced and maintained.

The final, and possibly most important reason to have a current practice valuation, is to protect the family and estate. All doctors have life insurance, health insurance, disability insurance, property insurance, etc. Why? To protect their family and estate from unforeseen risk. But most of these same well-insured dentists fail to protect the hundreds of thousands of dollars of value for their practice by not a current practice valuation to help their family sell the practice in a timely manner.

Dr. Gene Heller is the director of transition services for Henry Schein Professional Practice Transitions. He can be reached at (800) 730-8883 or [email protected].

Past DE Issues