The Dental Economics annual fee survey

Produced in partnership with the Academy of Dental CPAs Allen M. Schiff, CPA, CFE Jeremy Goodwin

Welcome to the 2016 Dental Economics annual fee survey. The Academy of Dental CPAs (adcpa.org) and Dental Economics have partnered to provide data gathered from more than 600 practitioners across the United States. The 2016 analysis was prepared to provide practitioners with an in-depth look at one of the driving forces behind the dental industry. Establishing the correct fees and having consistency between coding and procedures within your office is a critical aspect of profitability and production.

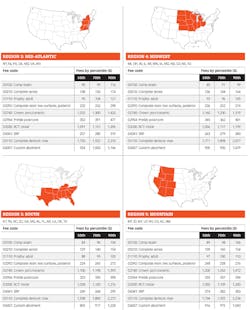

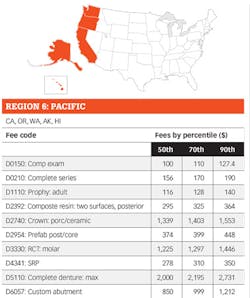

Regional fees

The fees have been arranged into six regions. States are subdivided into the six segments based on regionalized characteristics and market similarities. The data has been presented for the 50th, 70th, and 90th percentiles. The fee for the 50th percentile means that 50% of the survey participants charged that fee or less, and 50% charged more. Using a percentile method takes the outliers from the data set into consideration, and provides a more meaningful figure than the "average." The data is constructed to give users a baseline to see where their fees fall in line within their region. The data collected from the survey contains submissions from large metropolitan areas, rural towns, and all locales in between.

Despite large regional sample sizes, users may need to tailor fees to their individual markets, using practice location and local market differentiations as a consideration. The regionalized fees depict significant market variations and changes within the dental industry.

Determining fees

Please do not hesitate to reach out to a dental consultant or dental CPA for help in establishing the best procedure fees. The process of adjusting fees can be tricky, and utilizing help from a consultant or dental CPA will provide insight and analyze the opportunities within this sector of your practice. Practitioners sometimes unnecessarily fear that increasing fees will affect the consumer- patient's outlook as well as insurance. That is where your consultant or dental CPA can be your biggest advocate by capitalizing on the opportunities within your practice. This process will provide an additional level of analysis that will take many different market pressures and stimuli into account when making key decisions.

Looking to the future

Technology is one of the driving forces behind change in our industry. Adapting to innovations creates new opportunities and presents challenges. The industry has seen continual advancements in procedures and services, and there has been a shift in what patients expect. For example, 3-D imaging has created an implant placement evolution, allowing imaging to be considered more akin to standard care than in the past. As practitioners begin to utilize new technology and innovations, fees will need to be analyzed, at least annually, for factors like the cost of investment, procedural efficiency, increased variable expenses, and so on.

In conclusion, please meet with your consultant or dental CPA at least annually to review your fees. Make sure they are competitive within the marketplace in which you serve.

Allen M. Schiff, CPA, CFE, is the managing partner of Schiff Dental CPAs and the president of the Academy of Dental CPAs (adcpa.org). A dental CPA can minimize your tax liability, assist you in the accumulation of your wealth, and help you implement the internal accounting controls mentioned in this article. To locate a member of the Academy of Dental CPAs near you, visit adcpa.org or contact Mr. Schiff at [email protected] or (410) 321-7707.

Jeremy Goodwin is a staff accountant at Schiff & Associates LLC. Jeremy is a graduate of Towson University and a CPA candidate. He spent the first two years of his professional career specializing in accounting for the dental industry.