En garde!An office protocol for dental insurance

by Carol Tekavec, RDH

Patients have many questions regarding their dental benefits. While the employee coordinator or benefits director at the patient's workplace is the best source of information concerning individual benefits, the patient frequently turns to the dental office staff for insurance explanations. Frequently, these information exchanges are not the most cordial. Patients expect their insurance to pay for everything.

Dentists expect a patient's insurance to pay for many things. However, both dentists and patients usually are unhappy about how much insurance actually covers.

The adversarial relationship between payers and providers is longstanding and becoming more complicated every day. The ADA currently is pursuing several class action lawsuits against dental insurers. A suit last year against Aetna Inc. and Wellpoint Health Networks Inc. has focused on alleged improper provider reimbursement, "libelous" Explanation of Benefit language, and "tortious interference" in the business relationship between dentists and patients. As of this printing, Aetna has settled with the ADA, pending court approval. Details of the settlement can be viewed at www.ada.org.

In May of 2003, a lawsuit was brought against Cigna and Cigna's affiliate, Connecticut General Life Insurance; MetLife Inc. and its subsidiary, Metropolitan Life Insurance; and Mutual of Omaha Insurance Company. The suit alleges that the carriers have violated RICO (Racketeer Influenced and Corrupt Organizations Act), among other issues. Among the complaints are improper "downcoding" to less costly procedures, the use of undisclosed "cost-based" criteria to deny or approve claims, intentionally "slowing" claims-processing, and using economic power to coerce dentists with the threat of being denied patient referrals are among the complaints.

It remains to be seen what the outcome of these lawsuits might be in actual dollars and cents for dentists. But as it stands now, both patients and dentists rely on insurance to help patients pay for treatment. Few offices are able to ignore their patients' insurance issues, even when insurance is not "accepted" or benefits are not "assigned."

A recent study by the ADA showed that patients who have dental benefits receive more treatment than patients without this help. As with many other purchases that consumers make, cost plays a major factor in the buying decision ... and dental insurance helps mitigate the cost of dental treatment for patients!

Many dental offices accept insurance and try to help patients receive the best benefit possible. However, dealing with insurance is stressful. What can the average dental office do to make working with insurance less of a headache? Coming up with an office protocol can be an important first step.

Sample office insurance protocol

1) Obtain information. When new patients call, obtain as much insurance information over the phone as possible. This does not mean brow-beating them with financial questions! Ask them to bring their Employee Benefits booklet to their first appointment.

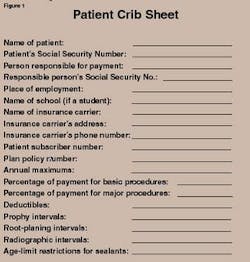

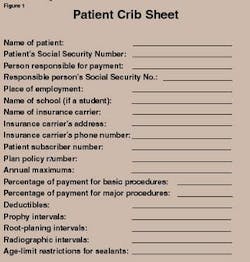

2) Create Policy Crib Sheet. Set up a policy crib sheet (See Figure 1) or computer file for the patient's plan at the initial appointment. A Policy Crib Sheet can be as simple as pages organized in a loose-leaf notebook or as high tech as a special computer file. Each insurance plan that the office deals with should have its own Policy Crib Sheet. See Figure 1 for the information that should be included on each sheet.

3) Inform patients of processing guidelines. In advance of the first appointment, send new patients an office brochure or letter that explains your office policies and how you deal with insurance. This letter or brochure should not be heavy-handed. It should approach the issue of insurance in a positive way. As an introduction to stating your office policies on insurance, you might say something like: "Whether your plan covers a major portion of your dental bill or only a small amount, dental benefits are good for patients because they help pay for needed treatment."

An office-chart form, signed by the patient and retained in the patient's record, also can be extremely helpful. Consider giving patients a copy of this form for their own files.

4) File claims electronically on a daily basis. Electronic claims should be used whenever possible and sent daily. Use e-attachments if the office has the capability of producing them and the carrier can accept them. If the office is using standard paper claims-filing through the mail, send in these claims daily as well. A "filing daily" insurance protocol tends to help keep accounts receivable on a better track.

5) Include detailed information on claims. Carriers are only required to pay claims that fall within the parameters of the patient's contract. Even treatment that is medically and dentally necessary may be excluded in the contract. While some treatment may not be payable no matter what, many procedures are covered when the claim includes sufficient information. Having the carrier ask for more information after a claim is already filed is not cost-effective.

Include detailed perio documentation (probing, bleeding, mobility, furcations and recession) for surgical or root-planing procedures. You should also include radiographs and probing depths for crowns. Whenever possible, attach photos of the case. Provide patient and treatment-specific narratives, not "canned" narratives from a list. Write narratives directly on the claim form or have them generated by computer. Anticipate the information that might be needed to make a claim clearer. In other words, make it easy for the claims reviewer to approve your patient's claim the first time!

6) Decide on the maximum number of times your office will bill the insurer. Some offices will bill a carrier twice — once every 30 days for 60 days — on behalf of the patient. Some will bill three times — once every 30 days for 90 days — and others will bill the insurer only once in a 30-day period. Whatever you choose to do, the important thing is to let the patient know your policy in this area.

Patient statements should reflect this billing. If payment is not made by the insurance carrier after the specified time, send a copy of the claim directly to the patient to file personally. (Do not keep rebilling and phoning the insurance carrier after the time period has passed.)

Include a letter to the patient explaining that the insurance carrier has not paid. Point out that when a plan does not reimburse the dentist promptly, the patient frequently can more readily obtain the benefits. (Carriers are often more responsive to patients and/or the employee benefits coordinators where patients work.) Offer to help the patient as much as possible to obtain their benefits.

Be sure to advise patients that the benefit check from the carrier will be coming directly to them when they file their own claims. They also need to understand that you will be billing them directly for the total amount due for your services. This is important! When the patients do the insurance-filing and the benefit check comes directly to them, they are responsible for direct payment to the dentist for the total amount due.

Developing an office protocol to deal with insurance not only frees the staff from trying to decide what to do about each problem as it arises, (which is time-consuming, difficult, and unrewarding); but it also can provide staff members with a welcome method of detachment from the patient's insurance problems. Staff members still provide patients with expertise, assistance, and cordial help with their insurance claims, but they detach themselves from accountability for the eventual outcome of the claims process. Patients understand from the very beginning that they are responsible for their total bill, and the office staff helps the patient to obtain their benefits. This results in a win-win situation for everyone.