Investment fund turnover rate

by Gene Dongieux, CIO, Mercer Advisors

Q When I look at my investment statement, I see that one of my funds earns much more than I’m actually getting even after including fees. Can you tell me why? The fund is Security Alpha Opp A, ticker SAOAX.A You lost quite a bit to taxes paid by the fund for high turnover (frequent trading). Here’s how it works:Most investors are aware that they pay a tax on investment gains when they sell. If they hold the investment a year or more, they pay the 15 percent capital gains tax. If they hold the investment less than a year, they pay the (usually much higher) ordinary income tax rate.

However, many investors don’t realize that the same rules apply to trades that fund managers make within a fund, even if they hold the fund itself longer than a year. Investors may not even pay this tax directly, but they see it reflected in the difference between what the fund earned and what they actually received.

Every time a fund manager sells a stock for a profit, the fund realizes a taxable gain. If the fund held the stock more than a year, the fund pays the 15 percent capital gains tax. If the fund held the stock for less than a year, the short-term capital gains tax is 35 percent.

The average turnover rate for all mutual funds is currently around 87 percent1 per year, which means the dollar value of the fund’s annual trades are equivalent to 87 percent of the fund’s total value.

From October 2006 to September 2007, your fund’s turnover rate was 1,300 percent, meaning the fund’s average trades totaled more than the entire value of the fund every month. In my opinion, this amounts to day trading, which I strongly discourage. Taxes and transaction costs can gobble up a big chunk of any gain you manage to get. Your fund did well compared to the benchmark if you look at before-tax performance, but once you look at what you actually take home after taxes, you have less than the index.

SAOAX before tax 26.0%

Russell Mid Cap Growth 21.0%

SAOAX after tax 15.3%

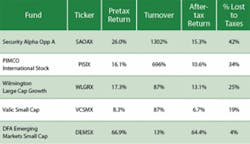

Not all funds eat so much of their own return with turnover. A passive or index fund in a stable asset class, such as large growth, may change very little. At the other end of the spectrum, Emerging Markets Small can have more turnover because the asset class has more movement, but even that can be minimized, as shown in the chart below. Still, some turnover is necessary to keep a consistent fund true to its investment objectives. Here is a sampling of funds with a variety of turnover rates.2 You can see that the lower the turnover, the higher the percentage you keep.

You are smart to realize that it’s not what you make, it’s what you keep that counts. The volatility of the market will affect turnover rates, so look at averages over at least 10 years where possible. In general, look for a turnover of 10 percent or less for a large growth and international large fund, and 20 percent or less for small, value, and emerging markets. High turnover is something you can watch out for and avoid before you invest to keep more in your pocket.

1Morningstar

2Morningstar, October 2006 to September 2007

Gene Dongieux is the author of If You Have It Made, Don’t Risk It: A Physician’s and Dentist’s Guide to Investing. As chief investment officer for Mercer Advisors, he manages over $3 billion in client assets. Dongieux has been quoted in “The Wall Street Journal” and “Investment Advisor” magazine. Contact him at [email protected].