Taking Advantage Of The Rich Uncle

by Raymond Doherty

New and existing tax laws may yield high ROI.

By employing the current tax laws and implementing the new 30 percent stimulus deduction, Uncle Sam is making an easy friend to those dentists maximizing their first-year deductions. However, it's a limited-time friendship offer (the 30 percent stimulus deduction expires September 10, 2004), making now the optimal time to invest in your practice and gain some valuable tax benefits.

With the new tax laws, your first-year tax write-off potential is high. However, these deductions are not automatically implemented (the government doesn't just give money away); you must elect to take advantage. Specifically, I will outline three laws that have been implemented that can have a significant impact on your future investments. Section 44, Section 179, and the recently passed "Job Creation and Worker Assistance Act of 2002" are all tax laws developed to help independent business owners like yourself.

In order to fully grasp the magnitude of these first-year deductions, let's consider a $100,000 investment for office renovations and the purchase of dental equipment. This example will outline an optimal scenario illustrating how existing and new tax laws can work together to provide you with substantial deductions.

Step One:

Go ahead… Make the investment

You've determined a need in your operatory. Meeting your operatory's need requires a total $100,000 investment. While many financing options are available to assist you in your endeavors, you should consult with your tax advisor to maximize the tax advantages outlined below.

$100,000 investment

Step Two:

Deduct Section 44 (if applicable):

Better known as the "Disabled Access Credit," Section 44 allows dentists to take a tax credit for expenditures incurred to make their practices accessible to disabled individuals. These expenses would include, but are not limited to, building or office improvements such as ramps, widening doors, or installing railings designed specifically to accommodate a disabled person, and certain practice equipment. Don't assume that the equipment you want is eligible for this deduction; you should consult with your tax advisor to determine if the equipment you purchase is eligible for the Section 44 credit.

If the item is purchased, the full amount is an "eligible expenditure," even when financed. The amount of the credit is 50 percent of each year's eligible access expenditures - to the extent they exceed $250 but do not exceed $10,250. The maximum amount of the Disabled Access Credit for any given tax year is $5,000.

$100,000 (initial investment)

-$5,000 (Section 44 deduction)

=$95,000 (Assuming Section 44 is

applicable and taken)

Section 179:

When writing off dental equipment, you'll generally find the best option is the "first-year expensing" method associated with Section 179. Instead of having to depreciate the equipment's cost over a period of years, Section 179 offers you a simple and fast way to write off dental equipment. The expensing method allows dentists to write off up to $24,000 of equipment purchases. That is up from $20,000 in 2000. (The annual limit is scheduled to increase to $25,000 in 2003.)

The Section 179 deduction isn't automatic; taxpayers who want to take the deduction must elect to do so. Those electing to take advantage of the increased tax deduction will also benefit by reducing their taxable income. Any excess above the expensed amount can be depreciated over five to seven years, depending on the equipment type.

$ 95,000 (adjusted price, see Section 44 above)

-$24,000 (Section 179 deduction)

=$71,000

New Bonus 30% Stimulus Deduction:

On March 9, President Bush signed a post-September 11 economic stimulus package into law. The new law, known as the "Job Creation and Workers Assistance Act of 2002," is intended to stimulate capital spending and allows for 30 percent additional first-year depreciation on new practice assets purchased during the three-year period beginning on September 11, 2001. This depreciation is in addition to the Section 179 deduction, offering dentists a three-year window of opportunity to take advantage of another tax benefit savings.

To qualify for this deduction, the equipment/property must be acquired after September 10, 2001, and before September 11, 2004. While the provisions of the new law do not increase the total deductions allowed for purchasing new equipment, they do accelerate most of the deductions to the first year of ownership.

This new law provides dentists with increased cash flow from the income tax savings. Remember that this is not a one-time deduction, but can be taken on new equipment you purchase each year up until September 10, 2004.

$71,000 (adjusted price)

-21,300 (30 percent stimulus deduction)

=$49,700 Net adjusted basis

Step Three:

Reap the benefits

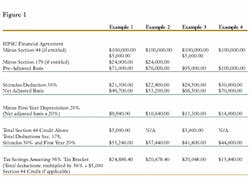

Figure 1 showcases four examples of the potential deductions your practice may receive from the existing tax benefits (See first example for the possible total tax savings of $24,886.40). This chart outlines only a few examples of the savings and immediate relief your practice could be taking advantage of.

Speak to your financial provider, tax advisor and/or accountant to be sure you're eligible for the tax laws outlined above and to determine a course of action to best meet your needs.

Just two months ago, Federal Reserve Chairman Alan Greenspan declared the recession "officially over." Through it all, dentistry has survived and new legislation has been put into place to solidify its good standing and economic impact. While Section 44 and Section 179 have been utilized by the industry, the 30% additional depreciation deduction was recently added as an incentive to increase spending and generate revenue in the dental marketplace.