Tuition strategies

By William J. Davis, DDS, Joseph Massad, DDS, and Gary L. Rathbun, CLU, ChFC

Investing for your child's future requires sound financial planning. The authors examine four options that offer both savings and tax advantages.

Photo by Rob Brinson at FPG International

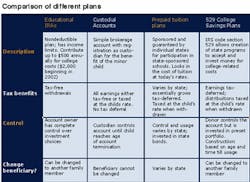

College savings plans are almost like buying a new car. So many options exist that we become paralyzed when trying to decide. Should you use an Educational IRA, custodial account, prepaid tuition plan, or a 529 College Savings Plan? Let's look at some of the differences in these four educational fnding options.

Educational IRAsEducational IRAs are a recent development in the tax code. This IRA allows after-tax contributions into an account that can grow tax-free. The maximum contribution allowed per year is $500, depending on personal income. Effective in 2002, this amount will increase to a maximum of $2000. The funds can be used for a wide range of college-related expenses.Educational IRAs have two distinct advantages. First, you control the investing of the money, such as mutual funds, stocks, or bonds. Also, the beneficiary can be changed to another family member. This becomes very important if your child is lucky enough to get a scholarship or, in some cases, decides not to go to college.

Custodial accountsCustodial accounts are very common and are usually established under either the Unified Gift to Minors Act (UGMA) or the United Transfer to Minors Act (UTMA). These accounts are set up like a normal brokerage account with a custodial account registration. All or a portion of the earnings are tax-free or taxed at the child's rate.Custodial accounts are more flexible about the ultimate use of the funds. They don't necessarily have to be used for college costs, but they do have to be used for the benefit of the child. When the child reaches a specified age, the account terminates. The child will then have total access and control of the assets in the account. Your contribution on behalf of a child is limited by the annual gifting restrictions of $10,000.

Each state sets its own guidelines regarding the transferability of tuition units to other children. The units can be used for tuition only; fees, housing, and other college expenses are not included. The maximum contribution is limited to 400 units or four years of tuition for each individual child.

When these plans first originated, the units could only be used for tuition at state schools. However, many state-sponsored plans are now allowing the units to be used in all colleges within the state. Some even allow the units to be used for out-of-state schools. Research all the details before investing in this type of plan.

529 College Savings PlanThe 529 College Savings Plan was created under Section 529 of the Internal Revenue Code. The 529 Plan is very similar from state to state; however, each state has features that are unique to its plan.The 529 Plan has become very popular in the last few years. Consumers should be cautious; some are more consumer friendly than others. States such as Arkansas, Maine, and Indiana have high annual management fees (1.8 percent to 1.6 percent). Iowa, Utah, and New York have much lower annual fees (.30 percent to .65 percent).

The annual maximum contribution to a 529 plan varies by state, from $25,000 to as much as $100,000. The highest lifetime contribution in one state is $150,000! When you consider the power of compounding and the amount that a 529 Plan can grow, your child could go to any school in the country.

529 plans have some important benefits. The funds grow tax-deferred for the life of the account, and the contributions flow out of the estate of the contributor.

Another unique feature of this plan is that contributors can retrieve the funds for their personal use. This type of withdrawal does have some tax disadvantages as well as a withdrawal penalty. Some states also allow a state income tax deduction for contributions into 529 accounts.

Regulations vary on whether or not individuals from out-of-state can set up accounts. For example, the Oklahoma College Savings plan is open to residents from any state and can be used for tuition at any qualified post-secondary institution. This makes this plan an attractive option for Texas residents, which does not offer a 529 plan. Make sure you are informed of all of the options before investing in any program. Finally, most programs will allow you to change the beneficiary of the account, as long as the beneficiaries are related.

Many individual mutual fund companies are getting into the 529 business. Merrill Lynch and Fidelity Investments have dedicated considerable resources to developing their own 529 plans. Each company manages one or more state plans that are open to just about anyone wishing to participate. The prospect of Merrill Lynch or Fidelity managing college funds for a child vs. a state government managing a college fund is reassuring for many investors.

College financing today is a challenge; economic forecasts indicate that costs will continue to increase dramatically. Careful research and planning, however, will help parents meet the challenge head-on.