The Dental Economics/ Levin Group 7th Annual Practice Research Report

Solid Recovery Offset by Outdated Systems

By Dr.Joe Blaes, Chief Editor

Patients are coming back and accepting more treatment but practice profits are not keeping up due to outdated systems, increased overhead, and lower collection rates.

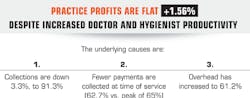

These are the key takeaways from the Dental Economics/Levin Group 7th Annual Practice Research Report, as gross production per doctor increased a respectable 12.6% while owner profits grew only 1.56% compared to last year's figures.

"The dental economy lags behind the macro U.S. economy by several years. For approximately two years, we've seen U.S. stock markets and employment numbers improving. Now, finally, we see signs in many practices that patients have returned and production is increasing," said Dr. Roger P. Levin, chairman and CEO of Levin Group.

"However, the flat profit level reflects the fact that costs – overhead – are too high, and collections are too low. This affirms my belief that practices need new management systems to address postrecession realities."

There are two caveats about the increase in production. First, though production is up by a healthy percentage compared with last year, it is still basically where it was seven years ago. The second point is that, because patients had been postponing treatment, the increase may be artificially inflated by pent-up demand.

About the Survey

With the comprehensive Dental Economics/Levin Group Practice Research Report, now in its seventh year, our findings provide a unique frame of reference for dentists across the country. It enables them to measure their practices against a large number of their colleagues' offices and also review how this year's data differed from previous years.

Levin Group designed the survey and collected responses – which were then tabulated and analyzed by the Levin Group Data Center™/Data Analysis Division. The resulting report provides dentists with accurate, timely information about the state of the business of dentistry.

This year's survey asked general dentists to provide practice data in six critical areas:

- Practice Overview

- Practice Production

- Collections and Billings

- Procedure Mix

- Overhead

- Doctor Satisfaction

The survey represents a broad cross-section of U.S. general dentists – from solo practitioners to multidoctor practices, providing care in rural areas, small towns, suburbs, and large cities. Response doubled compared with last year, which Dr. Levin sees as evidence that dentists today have a higher level of interest in the business side of dentistry.

"Dentists are getting the message that they need to track and analyze practice data," he says.

2013 Survey Highlights

What's New with Production and Income?

Average full-time doctor gross production rose 12.6% to $649,839, and full-time hygienist production increased 4.3% to $162,113. This year's data indicated practice growth (which includes practices with more than one doctor) was flat, averaging $1,180,022.

While there are lingering effects from the recession, the majority of responding dentists are optimistic about practice success this year. In the first six months of 2013, 59% of practices have seen an increase in production and expect this growth to continue through the end of the year. Only 14.3% expect a decrease in 2013. These metrics correspond to a trend seen in the latest ADA survey of Dentists' Economic Confidence.

Profits per owner grew a modest 1.56% to $245,625 for dentists who responded this year. This is an increase over last year but still lower than the 2010 peak of $262,641. This disappointing profit performance is explained, in part, by data showing the failure to collect fees that are owed.

Collections are down to 91.3% vs. 94.4% in the previous year. This is the lowest rate reported in seven years. Based on the practice production average of $1,180,022, this represents $36,581 in lost revenues. Not surprisingly, 13% of accounts receivable are over 90 days old.

To put these figures in perspective, Levin Group sets a collections target of 99% for its clients, which is readily achievable with the correct systems in place. For the average practice surveyed, improving collections from 91.3% to 99% would bring in an additional $90,862 in revenue.

Another troubling sign is that overhead continued to climb, from 60.8% the previous year to 61.2%. Levin Group recommends a 59% target for GPs.

Unfortunately, these last two findings – reduced collections and higher overhead – mean that many dentists are doing more work yet have little to show for it.

As Dr. Levin said, "Before the recession, most dentists could still do quite well even if overhead and collections were out of line. In the new dental economy, such inefficiencies can no longer be tolerated. The only way dentists can keep more of what they make is by operating their practices with excellent, proven business systems."

The daily numbers from the survey are worth noting:

- Average daily production per doctor was $3,486, up 7.9% from $3230 last year, but still below 2010 levels.

- Average daily production per hygienist remained flat at $1,000.

When asked how many days per week they worked, 15.8% of doctors said five days or more per week. This is up from 12.9% last year. The trend of more doctors practicing part-time continued, increasing from 16.4% in 2011, to 20.1% in 2012, and now to 21.6% in 2013.

Asked when they expect to retire, 2013 survey respondents indicated that they would be, on average, 65.5 years old. Though earlier than the average current retirement age of 68.3 reported by the ADA, it is still more than two years later than the 2011 prediction. Overall, these numbers reflect two negative trends – doctors are working more hours, and more years.

More Patients, Accepting More Treatment

After two years of declining new patient numbers, this year's responses signaled a rebound to the second highest level (27.9 new patients per month) in the past seven years. With more new patients presenting, GPs have begun making more referrals each month to specialty practices.

"The increase in new patients represents excellent news," said Dr. Levin, "but to handle them efficiently and profitably, practices need to evaluate their scheduling protocols right now. For the past few years, many doctors have probably just been concerned about filling the holes in their schedules. It's time to implement a scheduling system that accommodates more production with less effort. That's the key to profitability."

Last year, we reported that only 18.8% of GP cases were elective. This year, almost 21% of procedures were identified as elective. This confirms that doctors are doing more with what they already have. Practices all around the country continue to see increased use of credit cards to pay for treatment and a corresponding decrease in billing the patient after treatment.

Stress, Though Reduced, Remains Too High

Last year, there was an alarming spike in stress levels. We were pleased to see that stress levels have dropped back to below their five-year average. Last year, 35.2% of doctors reported high or extremely high levels of stress. This year, only 28.7% reported high or extremely high stress … a significant improvement, but still clearly a problem.

"Stress is a symptom of other problems in dental practices," said Dr. Levin. "When you consider the financial pressures doctors have faced in recent years, and that they are working more hours and more years, it's no wonder they feel stressed."

Perhaps this is one reason that more than a third of GPs (36.5%) are now using some sort of consultant or coach to help rebuild and grow their practices.

Two-Thirds of Dentists Ready for Better Business Models

One-third of survey respondents indicate that their greatest challenge is finding ways to increase practice production and profit. Another third of dentists report that inefficient practice systems are the primary barriers to their success.

Dr. Levin, noting that the number of new patients, elective treatment, and production have all increased, said, "The long-term outlook for dental practices has become much brighter, but only for those that change the way they do business. Doctors who adapt to the new market conditions quickly by replacing their outdated systems will be the ones who enjoy the highest levels of success."

Conclusion

We hope the Dental Economics/Levin Group 7th Annual Practice Research Report will enlighten you about the state of your profession and encourage you to make positive, innovative changes – changes that will position your practice for excellent growth in the new dental economy.

Our thanks to all the dentists who invested their time and effort in responding to the survey. Your voice has been heard, and we look forward to hearing from you again in 2014. To view the complete survey results, visit www.levingroup.com or www.dentistryiq.com.

For more on this topic, go to www.dentistryiq.com and search using the following key words: Dr. Roger P. Levin, annual practice survey, practice production, systems, collections, overhead.

Past DE Articles