Your Economic Dashboard: Personal Financial Ratios

by Doug Carlsen, DDS

Is your road to retirement fraught with the confusing nomenclature of the financial world? Does your head spin upon hearing asset allocation, diversification, large-cap, nano-cap, value funds, growth funds, REITS, price to earnings, dividend yield, TIPS, ETFs, and the 50-day moving average?

If you know more about NASCAR than NASDAQ and wonder what the connection is between the Indy 500 and the S&P 500, you are a normal dentist. Those who cringe at the thought of viewing your monthly software monitors, your personal Quicken budget reports, or anything that has a minus sign in front of, or ( ) around it, may find solace here.

Charles J. Farrell, in an article in the Journal of Financial Planning, January 2006, established an elegant set of ratios that individuals may use to analyze their personal financial standing. He named them Personal Financial Ratios.

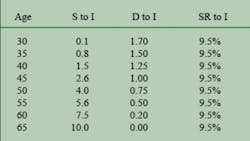

Legend: Savings to Income (S to I); Debt to Income (D to I); Savings Rate to Income (SR to I)

Just as stock ratios are based primarily on a company’s earnings, personal financial ratios are based on an individual’s income. The ratios vary at different ages, as debt gradually decreases and savings increase over one’s career. This “road map” provides benchmarks for the dentist to determine whether he or she is on track to retire at age 65. The ratios are not meant to substitute for financial advice or account for all the specific variations in people’s financial lives. However, they can provide a basic set of guidelines on your path to retirement.

There are three ratios:

- Savings to Income (S to I)

- Debt to Income (D to I)

- Savings Rate to Income (SR to I)

The following sections have rather technical definitions. You may wish to glance at Table 1 - Personal Financial Ratios - then read “specific dental issues” (Page 98), and finally come back to peruse the rest of the article.

Calculating the ratios

Savings - Savings include the current values of all tax-deferred and taxable investments, such as 401(k), profit sharing, IRA and brokerage accounts, the fair market value of any investment real estate, and a conservative approximation of the value of your practice. In other words, include everything except your house. Your home is excluded because people need a place to live. Moreover, few downsize in price during their retirement years; consequently, the equity in one’s home is not usually available for retirement income.

If you have a spouse with a defined benefit pension, multiply the expected annual income by 20 and add it into savings. For example: Benefit of $40,000 per year corresponds to an investment of $800,000.

Income - Both spouses’ incomes are included. If you are incorporated, salary and any other tangible yearly payouts are included. Include any passive income that is not from capital gains, dividends, or interest, such as a rental income.

Debt - When calculating debt, include all - practice loan principal, mortgage, student loans, auto, and consumer debt. Auto leases are included also.

Savings Rate - Include all 401(k) and company matching contributions, IRA, and any vested employer contributions, any other pre-tax contributions, and any after-tax contributions. Dividends, interest, and capital gains are not included. They are automatically included in the account growth calculations.

Table 1. Personal Financial Ratios

Assumptions: 6 percent real return, 5 percent withdrawals per year at retirement.

Savings to Income and Debt to Income are goals for the given ages. Savings Rate to Income is presumed to be a constant 9.5 percent. The above table is modified from the 5 percent real return table in the original text to a 6 percent real return rate using the author’s adjusted statistics.

Using the ratios

The ratios are based on total household income, debt, and savings rate, which means they can be used by a single head of household or a couple. If only one spouse works, use that person’s age. If both work and there is a large discrepancy in incomes, use the age of the higher-income spouse. If both earn comparably, use the average of ages. If there is a large difference in spouses’ ages, it would be prudent to do separate calculations for each.

Assumptions - First, Table 1 assumes a 6 percent real rate of return, after counting for inflation, for a long-term, 35-year cycle. Is 6 percent realistic? According to Jeremy Siegel, professor of finance of the Wharton School at the University of Pennsylvania and noted author, the long-term return after subtracting inflation for equities since 1821 has averaged 6.5 percent to 7 percent, and has been remarkably consistent over long-term investment cycles. Thus 6 percent appears a bit conservative.

Second, the ratio assumes a 5 percent withdrawal rate in retirement, with distributions being adjusted for inflation each year. Most financial advisors now recommend 4 percent to 5 percent, with the consensus at 4.5 percent. Thus 5 percent is a bit liberal.

In tandem with the conservative 6 percent rate of return, Farrell’s chart appears reasonable.

A hypothetical example - Let’s look at a typical 50-year-old dentist. Together with his 48-year-old wife, they have a combined income of $225,000. This family has the following financial circumstances:

- Income: $225,000

- Mortgage: $200,000

- Auto loan and lease: $25,000

- Consumer debt: $3,000 (monthly revolving balance on credit cards - not paid off)

- Total savings: $700,000 ($400,000 in investments and practice sale value of 50 percent of practice production of $600,000, equaling $300,000)

- Annual savings: $24,000 ($20,000 for dentist, $4,000 for spouse)

- Employer 401(k) match: $4,000 (for spouse)

Based on this scenario, the couple has the following Personal Financial Ratios:

Savings to Income: $700,000 ÷ $225,000 = 3.11

Debt to Income: $200,000 + $ 25,000 + $3,000 = $228,000 ÷ $225,000 = 1.01

Savings Rate to Income: $24,000 + $4,000 = $28,000 ÷ $225,000 = 0.124 = 12.4 percent

Let’s evaluate how our hypothetical couple is doing. Savings to Income is low (3.11 vs. target of 4.0), Debt to Income is moderately high (1.01 vs. target of 0.75), yet Savings Rate to Income is very good (12.4 percent vs. target of 9.5 percent). A strong Savings Rate to Income will bring other ratios in line within a couple of years assuming no other changes.

How is this information helpful?

The couple may be considering purchasing a new home or relocating the practice. These are normal desires for dentists in their late 40s and early 50s. As can be seen, their current savings rate is good and debt appears manageable, but both would suffer major blows with the high costs of relocating either home or practice. Savings to Income, now low, would likely not improve for several years, and Debt to Income, now moderately high, would rise astronomically. New loan burdens would make it very difficult to keep Savings Rate to Income at the present level. The dentist would have to produce a much higher income to keep these ratios intact. Remodeling one project at a time, rather than a new home purchase or office relocation, would be most prudent under these conditions.

Specific dental issues

There are certain periods in a typical dental career when saving is difficult and debt burdens are high. Examples include:

- During the late 20s to early 30s, a home and practice are often purchased, just when the dentist is starting a family. Saving during this period is usually sporadic at best, and Debt to Income can be much higher than listed in Table 1.

- Around age 40, many couples purchase an upscale home. Savings may stall as debt rises significantly.

- Near age 50, the dentist’s family normally incurs significant college costs while contemplating a possible office relocation or expansion. This time period is crucial to saving for retirement, as the dentist has reached near-maximum income, and has much less time for the savings to compound.

Because of these anomalies, it is nearly impossible for the dentist to save 9.5 percent consistently over a career. Also, Debt to Income will rise and fall during a career. It may be practical to consider the following:

➤Watch personal and practice debt closely when young. Often, young dentists incur a practice loan - up to $7,000 per month - along with a $3,000 per month home loan. This may put tremendous psychological burdens on the family, and can delay any real savings for years. It may be prudent to delay the purchase of a home for several years after starting a practice.

➤Attempt to save as much as possible between ages 30 and 40. One hundred thousand dollars invested in a normal portfolio of primarily stocks at age 35 will grow to $811,000 - in age 35 dollars - without any more additions, by age 65! (Assumes 11 percent return, subtracting inflation of 4 percent.) Early savings is the key.

➤Save at a rate of more than 20 percent per year when possible. What about borrowing for savings? Ask your financial advisor or CPA.

➤Allocate college savings and retirement savings properly. Ask your financial advisor.

➤Do you need that “trophy home” at age 40? I didn’t, yet bought it anyway. It leaked for five years and was a money pit! I missed out on three years of savings because of higher mortgage and maintenance costs.

➤Be careful of large purchases when the kids are in college. Often, college costs are more than expected. Several years of lessened savings often occur - don’t sacrifice your retirement at this time with large office expenses. Above all, work with a financial planner to monitor your retirement savings goals.

Final thoughts

The simplicity of knowing that you may need approximately four times your income in savings at age 50, and 10 times your income in savings by retirement may be helpful to many. These ratios are easy to calculate and the figures can most often be approximated without detailed calculation. The ratios also may be used to halt casual cocktail conversation at dental meetings. For example: “Bob, I know your new cone-beam tomography system works well and your production is much higher, but how has it affected your Debt to Income ratio? You’re over 50, so it should be less than 1.0.”

The ratios provided in this article are, at best, a rough guide for retirement savings. Planners use much more specific analysis, in particular, Monte Carlo simulation, to assess progress. Monte Carlo simulation is able to estimate the likelihood of achieving your goals by accounting for variability in the factors that contribute to your financial plan’s ultimate success by running hundreds or even thousands of “trials” on your financial plan. Financial Engines® is widely used by institutions, and can be accessed for a year’s trial for no charge. Happy planning!Douglas Carlsen, DDS, owner of Golich Carlsen (www.golichcarlsen.com), retired at age 53 from a 25-year private dental practice and clinical lecturing at the UCLA School of Dentistry. Currently, he lectures on The Dentist’s Number, a retirement workshop for dentist and spouse, and The New Dentist 2007 - Future Financial Scenarios and Solutions. He lectures, writes, and consults dentists on business and personal finance with emphasis on simplified budgets. Contact him at (866) 517-5493, or e-mail [email protected].