Consumed by consumables

by Brad Durham, DMD

Overhead in dental offices continues to climb. Supplies often take a bite out of our budget and our profits. In a continuing search to build the financial part of the exceptional dental practice, I’ve sought advice from Sally McKenzie, CMC, CEO of the McKenzie Company, who for more than 25 years has offered dentists financial advice they can sink their teeth into.

Brad: Sally, so much of dental office budgets go toward consumables, but there are technologies out there that can replace some of these expenditures. How do dentists invest in replacement technologies without breaking the bank?

Sally: When considering any new equipment, you must first determine the return on investment (ROI), the positive return, or how much is saved as a result of your investment, and the immediate return it will produce.

Brad: So much new technology seems expensive. How do dentists know if the investment is worthwhile?

Sally: The “direct cost” method is a straightforward way of determining the viability of an investment. Simply compare the cost of your current equipment with the expense of the new equipment that you will need to replace that function and see how quickly you can recapture your investment.

Brad: OK, how about an example?

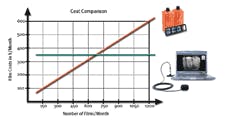

Sally: Here’s one I use repeatedly because it never fails. Many offices are “going digital” for their radiography needs, necessitating the replacement of traditional X-ray equipment with a digital X-ray system. Initially, some get “sticker-shock”; they are unaware that they’re already spending money they won’t need to spend once they have the new equipment. The hard costs of film, mounts, chemicals, and disposal run more than 50 cents per film. Don’t forget duplication and retakes - pennies can eat into profits. Multiply that by the number of X-rays you take in a month. Most dentists are surprised at the hundreds of dollars they spend each month on these consumables alone. And you never get a return on those!

Brad: You and I know that there are other considerations, too.

Sally: Absolutely! Besides supplies, consider the time involved in taking, developing, mounting, and sometimes retaking X-rays, as well as processor upkeep, time that translates into unrecoverable money. You may think, “What’s a few minutes?” But figure out how many minutes it takes to produce the actual X-ray, multiply that by the number of times each team member does this every day, and then by their hourly pay rate. Get ready to be shocked by the hundreds of dollars spent having your assistants complete these tasks instead of spending time with patients.

Brad: So, what’s the alternative?

Sally: Going back to our digital X-ray scenario, I challenge dentists to calculate the direct cost of their film-based radiography. More often than not, the average solo practitioner takes 60 X-rays per day, and uses about two hours of staff time handling the film. This can add up to about $1,300 per month. The typical starting point for a quality digital X-ray system is approximately $350 per month. That’s an ROI of more than $950 per month. How does it make sense not to take advantage of this technology?

Brad: What are the tax incentives?

Sally: As per my accountant, a deduction based on Section 179 of the Internal Revenue Code allows small businesses to take the entire cost of the purchase of new equipment within the year it was purchased, with certain restrictions, up to $108,000. Prior to this act, businesses had to amortize equipment purchases over a five-to-seven-year period. Basically, after you calculate the ROI, you will see that you can afford to improve your technology and realize your ROI in just a few days or weeks, depending on the size of your practice.

Brad: Thanks for helping us all realize a cost-effective solution to the problem of throwing our money at consumables.

Sally: It’s my pleasure!Dr. Brad Durham has practiced dentistry for 25 years with an emphasis on the treatment of head, neck, and facial pain, dental cosmetics, and complex dental reconstruction. His practice combines art, science, and technology with personalized care. He is a clinical and featured instructor at the Las Vegas Institute, and was the first in the world to earn the LVI Mastership award for esthetic reconstruction. Dr. Durham teaches a series of courses titled “The Niche Practice” at LVI and his home in Savannah, Ga. Contact him at [email protected] and www.nichepractice.com.