The Practical Investor — A mutual fund portfolio for all seasons

The authors demonstrate how investors can generate the returns they need for their retirement goals without unnecessary risk.

by Marvin Appel, PhD and Brian Hufford, CPA, CFP

Imagine yourself within a few years of retirement. You have a good nest egg, are in good health, and are not particularly interested in spending a lot of time following the market. With today's life expectancies, your savings are likely to have to support you, or a spouse, or both for more than 20 years. Future inflation and interest rates are unknown. How can you invest your savings to provide enough income to retire with while keeping your savings intact in the event of another bear market?

Only extremely prodigious savers — those with savings that can cover 25 years or more worth of expenses — will enjoy financial security just on money market or bank CD returns. Many dentists may have accumulated adequate savings — enough to support their retirement — but only if invested where long-term returns exceed what is available from the lowest risk investments. For most, the need for higher returns requires some investment in the stock market. Unfortunately, the stock market can be dangerous, and most professionals who are contemplating or are already retired simply cannot take excessive risks with their savings.

The solution: a mix of mutual funds to balance risk and reward. In this article, we suggest a mix of mutual funds that for more than 20 years have had a successful history of protecting capital while providing good returns given the risk involved. The strategy can be implemented by investing low-cost mutual funds. We believe that this approach represents a good compromise between potential risk and reward for long-term investors who are not in a position to adjust their investments frequently in response to changing market conditions. Of course, there is no guarantee of any future degree of profitability or safety.

Why hold different types of funds instead of just the best performers? Stock funds have historically produced better returns than bond funds, but have also suffered steep losses during bear markets. At the other end of the safety spectrum, money market funds have not had a losing year overall, but the returns are limited and may vary widely from one year to the next. Currently, many such funds pay under 3 percent per year, barely keeping up with inflation, if at all. Bond mutual funds usually lie between stock funds and money markets in terms of their profitability and risk.

The good news for cautious investors is that even though different types of stock and bond funds have had losing years, in many cases, losses in one category can be mitigated by gains in another. The goal in putting together a relatively safe investment program including equities is to mix different types of investments in the hope that losses in one part of your holdings will be cancelled out by gains elsewhere. During good years, it is expected that all parts of the portfolio will be profitable to at least some extent.

For example, the S&P 500 has lost 27.6 percent (including dividends) since the start of 2000. Yet, this has been a very good time for bond funds — the average long-term corporate bond fund was up 16.8 percent during the same period. In 1999, the reverse was true: stocks rose while bonds did poorly. Although this has not always been the case (in 1973 and 1974, both stocks and bonds lost money), historically it has usually been easier to avoid large losses by holding both stocks and bonds.

Along the same lines, stocks in different types of companies may at times behave very differently. One widely followed index, the S&P 500, represents a basket of stocks in 500 large U.S. companies.

These 500 stocks, even though representing only 10 percent of publicly traded companies, represent the lion's share of the dollar value of all stock market assets.

More numerous, but lower on the financial radar, are stocks in small companies. Stocks in small companies that appear inexpensive on the basis of current company assets or sales or earnings (for example) are called small- cap value stocks.

Over decades of market history, the returns on small-cap value stocks have been at least as good as those from the S&P 500. But often as a group these stocks have thrived during climates that were unfavorable for S&P 500 stocks, and vice-versa. For example, in 1998-1999, the average small-cap value fund gained under 2 percent while the S&P 500 gained over 55 percent. From the start of 2000, however, the same type of mutual funds gained over 14 percent even as the broader market has tumbled.

Money market funds reduce the risk of the portfolio, but historically have returned less than either stocks or bonds. The more you hold in money markets, the more tolerable your losses during bad times, but the more modest your returns during favorable periods.

A simple yet effective investment program

We have put together a hypothetical portfolio designed with the goal of keeping losses to a minimum during bad years while providing significantly greater returns than money markets or bank CDs. The mix of funds should be:

- 20 percent S&P 500 Index fund

- 10 percent small-cap value fund

- 20 percent high-quality corporate bond fund

- 20 percent real estate investment trust fund

- 30 percent money market fund.

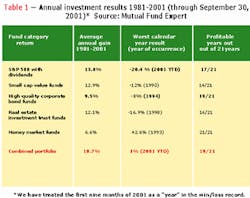

Table 1 presents the historical track record since 1981 for this portfolio. The odds of a losing year with the portfolio (2 out of 21 years reviewed) are as low as if an entire portfolio had been held in bond funds. The worst calendar year loss was smaller with the mix of funds than with the average bond fund alone. Yet, the compounded return was better than what would have been achieved with income-producing investments alone. By mixing different types of stock funds with bond and money market funds, the past returns are increased and risks are decreased compared to holding bonds alone — even during the severe bear market of the past year and a half.

Note that during the minority of years when any one type of mutual fund or the recommended portfolio showed a loss, the decline may have been greater at some point during the year than it ended up being by year's end.

Putting this information into action

You should open the fund accounts and allocate the amount you wish to invest. For example, the Vanguard Mutal Fund family offers the funds to help investors construct this type of portfolio, including:

- Vanguard 500 Index (S&P 500 index fund, ticker VFINX)

- Vanguard Small Cap Value Index (ticker VISVX)

- Vanguard Long Term Corporate Bond Index (investment grade corporate bonds, ticker VWESX).

- Vanguard REIT Index (real estate stock fund, ticker VGSIX)

- Vanguard Prime Money Market Fund (ticker VMMXX).

Vanguard funds have low expenses relative to most other fund families and no sale charges — significant for a long-term investment program. There is no guarantee that a particular Vanguard fund will perform better than any other mutual fund with similar objectives in any given period. However, low fund overhead has historically tipped the odds in the investor's favor.

Some funds require a minimum amount to invest. Vanguard Funds typically require a minimum of $3,000. Every year after opening the account, you should rebalance the assets so that each year starts in the correct proportion.

In the past, the approach outlined here has achieved greater returns than bond funds with a slightly lower risk, as measured by the worst calendar year loss. The strategy requires only minimal effort to construct and maintain the portfolio. For those of you who hold equity funds long term, diversification to include these categories of funds may make your investments safer while continuing to produce good returns.