Why I'm bullish on the market

by Gene Dongieux, CIO, Mercer Advisors

For more on this topic, go to www.dentaleconomics.com and search using the following key words: stock market, S&P 500, economy, investing, bullish on the market, Economic Freedom®, investors, capital growth, T-bills, Gene Dongieux.

We will be talking about 2008 for a long time. The S&P 500 lost a total of about 38% through the end of November, the most recent data for this article. Yet the market is still the best way for most investors to reach their financial goals.

To put this year in perspective, consider this chart (Fig. 1) of annual returns from 1926 to 2008. This is not cumulative returns; this is simply a plotting of each year's returns.

The shaded area of this chart defines one standard deviation from average (the line in the center), meaning about two thirds of returns will fall within this range. One standard deviation less than the 10% average is about -11%. Two standard deviations less than the average is about -31%, and about 14% of annual returns will fall between -11% and -31%. As of the end of November, the market was down 37.7%, which happens only about 2.5% of the time. You can see that there was only one deeper downturn in 80 years. In other words, returns like this are freakishly unusual.

You can also see that soon after a deep drop, the market rebounds with above-average returns. This is not market timing — we do not know when it will happen — it's the simple law of averages. Returns have to return to the mean.

A lot of investors learned in 2000 that there is not a new economy, just infinite variations on the old one. In 2003, they learned that the market, as an anticipatory indicator, is the first major economic indicator to react to a recovery. GDP, consumer confidence, and unemployment tend to react months later. That is only one of many reasons that timing the market has proven nearly impossible.

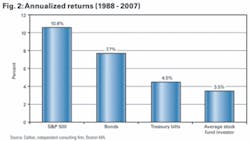

This chart (Fig. 2) shows the difference between what the S&P 500 returns and what average stock investors receive. Every time investors make a bad decision, this difference compounds. Stock fund investors who dart and dodge do worst of all. Deciding to get out of stocks is often just the first bad decision because there are always opportunities, even in a bear market. Every day out of stocks has shown to be another bad decision. Cumulatively, these decisions pull investors further and further from their financial goals, until eventually they are out of reach.

Of all the many investors who shunned stocks this year, I wonder how many asked themselves what they are going toward? What can offer a reasonable return with more security? If you did not know that the volatility of stocks is why they have higher returns, where would you look? Low-risk/low-return bonds or T-bills? Inflation-vulnerable cash? None of these have the potential to get most people to their goals.

People who hide in treasuries will miss out on the stock recovery because, in the long run, stocks are the place to be. In fact, for more than 80 years (the period for which we have quality data), stocks have been the place to be in the long run.

Even during the oft-invoked Depression, stocks were the best way out of market losses. One hundred dollars invested on Jan. 1, 1928, almost two years before the crash, gained more than 250% 20 years later. In comparison, short-term Treasury bills returned 81%, less than a third of stocks.

I'm bullish on the market because investing in capital growth (as opposed to betting on price or debt payment) is still the most reliable road to Economic Freedom®.

Gene Dongieux is the author of “If You Have It Made, Don't Risk It: A Physician's and Dentist's Guide to Investing.” As chief investment officer for Mercer Advisors, he manages more than $3 billion in client assets. Dongieux has been quoted in The Wall Street Journal and Investment Advisor magazine. Contact him at [email protected].