Can market timing work?

by Brian Hufford, CPA, CFP

For more on this topic, go to www.dentaleconomics.com and search using the following key words: market timing, passive investing, active investing, S&P 500 Index, Brian Hufford.

With uncertainty in the economy and many baby boomers' retirement hopes on the line, now is an important time for retirement investors to be confident in their investment approach. Is the worst over for the stock and bond markets or are even more challenging times ahead? Is now the time to shift to a higher percentage of fixed income or bonds while reducing stock exposure? These are key questions for retirement investors.

Market timing is an epithet among professional investment advisors and the investment public. Usually, it is dismissed with the somewhat intellectually dishonest logic that says if an investor misses just the best 20 or 40 days of investment returns during a period of time, the investor will have significantly underperformed the S&P 500 Index.

I decided to put market timing to the test. With the comprehensive investment database of Ned Davis Research, I created a study about market timing based on the question, “Why would anyone ever buy and hold stocks?”

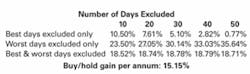

Even though the market was up by 15.15% per year during the 10-year period from 1987 to 1996, if one would have simply missed the worst days during that period, investment performance would have improved dramatically.

By missing only the worst 20 days, the investor would have improved performance to 27.05% per year. By missing the worst 40 days, performance would have improved to 33.03%. To me, the best-or-worst-days argument does not prove or disprove the validity of market timing.

A table summarizing these results for the 10-year period from Dec. 31, 1986, to Dec. 31, 1996, is shown below.

If an investment advisor equates market timing with becoming too aggressive or too conservative, based upon the mass psychology of the “herd” of investors, then it can be proven that market timing doesn't work.

By analyzing AAII Investors' opinions from surveys for subsequent six-month periods, it can be shown historically that when the herd of investors are too bullish, one should be out of the market, and vice versa.

Since 1987, when more than 65% of AAII Investors polled were bullish, the market has declined 2.8% per year. When less than 59% were bullish, the market has increased 8.5% per year. Most studies on market timing by firms such as Dalbar show the poor performance from investors who react emotionally after following the herd of investors.

Ostensibly, this means that investors should discount their emotions and the prevailing market sentiment of the news media and other investors. Independent thinking is critical, though at times nearly impossible.

Perhaps the correct way to frame the market timing argument is to examine the challenges of passive investing vs. active investing for a retirement-minded dentist. To me, there have been no truer words spoken than “past performance is not indicative of future performance.”

But what can be shown from the past 100 years is that while the S&P 500 Index increased by 8.8% annually, there were many periods when retirement-minded dentists simply could not have remained in retirement. This is based on a “buy-and-hold” approach and periods ranging from 16 to 20 years in which stocks exhibited negative performance.

These long periods of negative performance are termed “secular” bear markets. Fixed-income investments or bonds also have had long challenging periods of time when higher inflation was evident. When stock returns are down, bonds are not necessarily a safe haven either.

I believe that the next 10 years could present challenges for stocks and bonds as difficult as those in 2008, along with the potential for significant rallies. But I think these rallies will be against the longer-term secular bear market.

If this is true, then active risk management, as opposed to a buy-and-hold approach, may be important. But even if a secular bear market is present, there is no guarantee that any financial advisor successfully can navigate it.

I believe it is important for investors to understand the potential risks of an investment strategy, passive or active, for a retirement goal without summarily dismissing an active approach as market timing — whatever that means.

Brian Hufford, CPA, CFP®, is CEO of Hufford Financial Advisors, LLC, an independent, fee-only planning firm that helps dentists achieve financial peace of mind. Contact Hufford at (888) 470-3064, or [email protected].