Are you investing rationally?

Gene Dongieux, CIO, Mercer Advisors

For more on this topic, go to www.dentaleconomics.com and search using the following key words: stock market, investment advice, building wealth, diversified, Gene Dongieux.

Anyone who writes about current events for a magazine like this has a tough job. You're reading this in June, but I wrote it back in March. So what investment advice can I give to you, who live in a world I haven't even seen yet? If that sounds like a reasonable question, then you have a short-term orientation.

In last month's column, I wrote about the indispensability of having the right systems in place to support success. But systems, advice, or any good idea only work if you follow them. If you abandon your support because “things are different now,“ then you're right back at square one.

If it were easy, everyone would be a successful investor. But everyone is not. Success isn't measured by where the Dow is on any given day. Success is measured by whether you make the most of the financial opportunities that come to you. As a dentist, you have more opportunities than most, but not so many that you can afford to squander them.

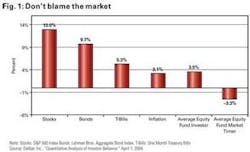

The chart below (Fig. 1) is a real eye-opener. It shows that average investors following their instincts or advice earned less during 20 years (1984 to 2003) than even low-risk t-bills. How does that happen? The market timer figure, which is even worse, is a clue. The average investor loses ground by changing position, generally trying to realign with something that has just peaked, which is called chasing the market.

Chasing the short-term market is what our instincts compel us to do. It's what causes big bubbles, big troughs, and big losses. Only the rational side of our brains can overrule the impulse, and only if it knows why.

Here's why: your investment time horizon — the time you are an investor — begins the day you invest your first dollar and ends when you spend your last dollar. If you plan to spend all of your savings, that totals about 60 years. If you plan to leave a significant amount behind, it's indefinitely long.

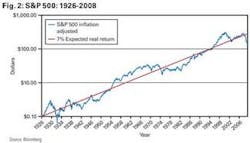

When your goal is to save, invest, and maximize your assets over the long term, how important is three months? Not very important. Look at the chart below (Fig. 2) showing the inflation-adjusted return of the S&P 500. In 82 years, the market has hovered around a 7% real return.

Do you remember what the market did for three months or even a whole year 20 or 30 years ago? Neither do I. In the long run, it's just one more period — as long as you stayed in the market.

Market timers make their reputations on one important call. Elaine Garzarelli called the drop in 1987. Bob Brinker called the top of the dotcom bubble. Peter Schiff called last year's fall. Their advice sounds very convincing on the heels of a big win (avoiding a big drop). They seem to have it all figured out. But notice that no one, not even Warren Buffet, is making these big calls consistently.

The day you stop listening to short-term forecasters, stop reading “what to do now“ books, and ask what investment strategy works best in the long term, is the day you become a successful investor. You don't need one-time luck. You need a steady, diversified, consistent plan that takes best advantage of your long time horizon, your risk tolerance, and the way the market works to meet your investment needs. You need the rational discipline to stay with that plan, even when your instincts tell you to do something different.

Gene Dongieux of Mercer Advisors, is the author of “If You Have It Made, Don't Risk It: A Physician's and Dentist's Guide to Investing. Mercer Advisors offers integrated 360° Planning™. Gene has been quoted in The Wall Street Journal and Investment Advisor magazine. Contact him at [email protected].