Are the numbers crunching you?

What can you learn from Dr. Abel`s financial statements? Plenty, but only if you use the knowledge on a regular basis.

Bryan T. Marshall, DDS

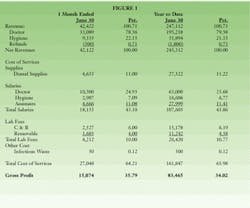

In the October issue of Dental Economics, we took a look at Dr. Abel`s finances and determined that he had a payroll problem. Since his financial statements were in such disarray, it took quite a bit of work to find the source of the trouble. Now let`s see how a timely, well-done set of financials can be helpful in avoiding problems.

To have something useful, certain recommendations should be followed. First, as stated in the October issue, we need to find an accountant who is knowledgeable about the business of dentistry and committed to delivering your financial statements in a timely manner. Dentists should share the responsibility of timely statement delivery.

Using a check-writing program - such as Quicken - organizes the financial information and decreases preparation time. It also will cut your accounting costs - since you are doing some of the work - and allow you to have a mid-month update on the health of your business.

One of the first changes noted in the new statements was a separate line item for hygiene production. This information allowed Dr. Abel to better manage his hygienist`s time for the overall good of the practice. It also allowed him to supervise her portion of the business so that it would not cost him to have her in the office. Properly paid and armed with incentives, a hygienist can be a wonderful asset in the growth of a practice. The opposite is true of one who is overpaid and underutilized.

The next change we see is that staff salaries have been separated. Hygiene is a separate line item, as are dental assistants and front-desk staff members. Hygiene and dental assistants have been placed in the "cost of services" category, while business staff or front-desk personnel have been noted in the operating expenses. Why are the front-desk staff members placed in operating expenses? In October, I mentioned that "cost of services" was related to anything directly responsible for producing dentistry; everything else is an operating expense. Since front-desk personnel are not clinical, they are not directly involved in producing dentistry and are thus regarded as an operating expense.

We also see that Dr. Abel`s lab fees have been broken down into crown and bridge and removable. Tracking them separately makes it is easier to keep them within your set parameters. Without a separation, it may be several months before a potential problem is identified. If you notice that your crown and bridge lab fees have gone up but your removable lab costs have not, then it is either time to raise your crown and bridge fees or find a different lab.

Although we noted that Dr. Abel didn`t believe in advertising, he placed a half-page advertisement in the Yellow Pages. Since the cost of this ad is placed on the phone bill, it often is charged as a phone expense when it is truly an advertising expense. By separating it, Dr. Abel can see if he is "getting his money`s worth" from this advertising.

We also noted that his insurance cost was separated into "doctor only" and "general/group." These categories are much too large to be useful. The categories should be subdivided into property, office overhead, malpractice, worker`s compensation, life, and medical. By doing this, Dr. Abel can notice a rise in any individual category and look for another provider, if necessary. Since Dr. Abel is an employee like everyone else, it makes no business sense to have his insurance segregated out.

Our next subdivision is office expenses, which should be separated into two categories - office supplies and equipment. We can include furniture in the equipment section, as well as computers, copiers, etc. Supplies should be separate, because these are replenishment items where costs should be controlled. Anything that should be controlled needs to be tracked!

In October, we noted that Dr. Abel owned his building, but one category that is missing from his financials is a line item for rent. Even though he owns the building, Dr. Abel needs to charge a reasonable rent for the commercial space he is using. There are many business reasons for this, some of which have to do with taxes and benefits. This is one particular area where a knowledgeable accountant would be invaluable. By charging rent, Dr. Abel can shift income to another area that may have tax benefits. By not charging rent, he is showing inflated returns on his business, since a major cost of operations is not reflected in the financials.

Our last change is separating the utilities category into water and sewer and electric. Again, the reason for this separation is to track costs. It may not seem like a large amount, but, over the years, any cost savings can be significant.

Now Dr. Abel has the proper financial tools to assess his business on a regular basis. He can easily track his payroll, as well as his supply and laboratory costs. Not only can he see how he is doing every month, he also can compare his monthly figures with his year-to-date numbers to see if they are consistent. If something seems out of place, it should stand out immediately.

In this particular example, everything seems to be fairly consistent, but there are some problem areas that need to be addressed. Rent is too low, which would not be a problem if he didn`t own his building! The other significant problem is the high cost of dental supplies. This is consistent with his desire to be on the "cutting edge" regarding innovations, as well as his lack of planning in ordering supplies. Again, without timely, properly prepared financials, this is an area that could easily go unnoticed.

It is important to remember that financial statements, like all tools, must be utilized regularly to be effective. Performance goals for expenses need to be set and measured monthly. If something is not in line with your goals, it needs to be explored and addressed. That is where financial statements have their usefulness. They can be an excellent yardstick to measure the performance of your practice, but only if they are properly prepared and used on a regular basis.