The DDSO: Dentist-owned private group models

Editor’s note: This article is part one of a three-part series. Click here to read Part 2, and click here to read Part 3.

Editor's note ii: Watch the new DE's Recall Visit video with Dr. Brady Frank and Dr. Chris Salierno, as Dr. Frank elaborates further on the DDSO model. See if a DDSO is right for you and your practice by watching the video here.

Brady Frank, DDS

When I purchased my first practice in 2001, the year that I graduated from dental school, the roadmap for success in private practice seemed well defined. Over the last 15 years, however, the dental landscape has changed significantly. I won’t get into the myriad clinical changes that have happened in the last 15 years. Instead I will focus on how the business environment of dentistry has changed—and specifically on the conglomeration of a very fragmented dental industry and how private practice dentists can leverage these changes for practice growth.

Fifteen years ago, a very small percentage of dental practices were contracted with dental support organizations (DSOs). Today that number is much higher and growing rapidly. For many dentists, this has caused concern. Others are excited about new opportunities. Whichever side of the fence you are on, you can learn the specialized knowledge, techniques, and protocols that the most successful DSOs have used and take part in dentistry’s new boom.

My background in dental transitions has given me insight into today’s ecosystem of DSOs, solo practitioners, and other practice models. After providing more than 30 Phasing Out seminars between 2006 and 2008 and consulting with hundreds of dentists about transition models, I noticed some trends. Most notably, I found this American Dental Association statistic to be true: the average age of retirement among dentists is 68.8.1

To avoid becoming casualties of this statistic, savvy dentists must use practice models that have produced financial abundance and security for dentists in the past. As I became more active in the dental transition environment, I began working with more private group practices and joined the American Academy of Dental Group Practice (AADGP), studying DSOs that had proven track records of success. When I started applying my transition background to the DSO environment, a new breed of business models began to form. I call these DDSOs: DSOs that are majority-owned by dentists.

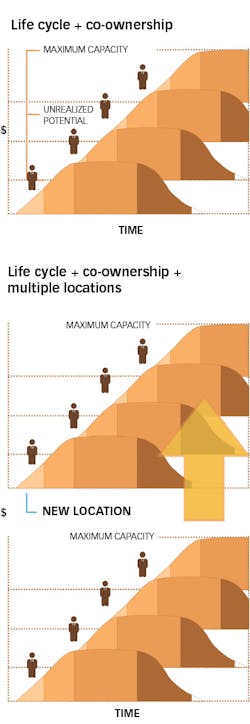

This illustration of the life cycle of a practice allows us to visualize areas of opportunity. On the front end, there is the opportunity for practice growth and equity. During the later stages, there is the opportunity to acquire a practice for the growing DDSO.

DDSOs incorporate the strongest business systems of DSOs, with modern private practice management and ownership. These systems include passive income, vertical business opportunities, creative mergers and acquisitions, multistate expansion, dual-entity approaches, economies of scale, and continuing education via advanced IT. Many of these systems were previously untapped by private practice dentistry.

In studying these models, I discovered that the most successful transitions have 45 elements that overlap to form the foundation for this success. I believe these elements are the key to predictable success in all types of dental practice transitions. Following 80% of these principles can improve the chances of transition success for a new dentist transitioning into ownership, a solo practitioner transitioning into multidoctor or multilocation ownership, or a private group practice transitioning into a DDSO.

In light of these changes, I recommend strategically planning your future immediately, whether you are a dental student, a solo-practice owner, or an owner of a group of private practices with multiple associates. The dental practice transition is no longer an event but a process—the earlier a dentist engages in the process, the higher the likelihood of success. Let’s dig deeper.

A DSO can be owned entirely or partially by private equity companies, institutional investors, licensed dentists, unlicensed dentists, or executives. In the past, many of these organizations were called corporate group practices. The terminology was not entirely accurate because unlicensed dentists cannot legally own dental practices or professional corporations (PCs) in most states. There is a clear delineation between the PC and the DSO. The DSO provides consulting, business management, vendor relations, and real estate and HR services not directly related to the clinical practice of dentistry. The PC, or clinical entity, provides the direct clinical services to patients and partners with or employs all clinical providers. The DSO and the PC become connected by a simple dental services agreement that explains which services each entity will provide.

The DSO’s dual-entity approach also allows for income that is not directly related to the practice of dentistry. When this approach is integrated with transitions, scalable expansion comes within reach of everyday private practitioners.

At the very core of these business models is the premise of dentists as owners, as opposed to associates. I have found clinical dentist co-owners to be more productive and motivated than associates.

After acquiring a value-added practice in the regression stage, the practice can multiply equity growth by adding clinical co-owners. Revenue created through partnership sales allows for investment in new locations. This benefit is realized by both the practice founder and the new clinical co-owners.

The average rate of associate turnover in the United States is about 18 months, which can cause the practice to lose momentum and lose resources to recruitment. As a personal example, I had 28 associates work for my group during my first seven years out of school. Now I only work alongside clinical co-owners. Notice how I did not use the word “partners.” Partnerships have a high failure rate, whereas clinical co-ownership is successful with limited cross liability.

Next month, the second part of this series will delve deeper into the different variations of co-ownership. I will also teach you about adding a trial partner and how this differs from adding an associate. I will discuss all sorts of topics, including equity harvesting, dividing the business into different legal entities to maximize profit and flexibility, and the principles behind debt-free practice expansion. Lastly, I will explain the value-added practice acquisition, which is the acquisition of a practice that has a high potential for value increase and a favorable return on investment.

No matter what phase of transition you are in, whether you are a new dentist or phasing out of your career, part two will help you begin strategically planning your future.

Reference

1. Munson BA, Vujicic M; ADA Health Policy Institute. Number of practicing dentists per capita in the United States will grow steadily. http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/HPIBrief_0616_1.pdf. Revised June 2016. Accessed August 31, 2017.

Brady Frank, DDS, acquired Phasing Out Seminars in 2006. He has presented more than 36 seminars about transition strategies across the nation. Dr. Frank is also the founder of OsteoReady Implant Solutions. In 2016 Dr. Frank founded TransitionTime, which provides continuing education, consulting, and transition management coaching. Dr. Frank is the cofounder of multiple DDSOs in the United States. Email him at [email protected].