Tax advantages available on fourth quarter 2009 equipment purchases

An IRS Code 179 update!

For more on this topic, go to www.dentaleconomics.com and search using the following key words: IRS Code 179 deduction, tax advantages of Code 179, Allen M. Schiff, CPA, CFE.

Dental practices that invest in their practices by replacing outdated equipment with the latest dental technology, position themselves to provide nothing short of stellar service to their patients, and at the same time increase their overall production.

In Feb. 2009, Congress passed new tax legislation extending the $250,000 IRS Code Section 179 deduction and the 50% Additional First Year Depreciation (AFYD). Both were scheduled to expire Dec. 31, 2008, and have been extended through Dec. 31, 2009 (as of this writing).

You may ask, “What is an IRS Code Section 179 deduction?”

With the extension of the $250,000 Section 179 deduction to 2009, you may elect to expense up to $250,000 of qualified property you buy during 2009. This accelerates the depreciation deduction into 2009. You do not have to wait five or even seven years to get the full tax benefit of 2009 equipment purchases. “Section 179 property” can be new or used; however, it cannot be acquired from a related party.

How does it work?

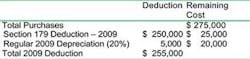

Let's say you are considering purchasing a hard/soft tissue laser for $70,000, a digital pan for $60,000, a new chair and unit for $20,000, and CAD/CAM dentistry, a CEREC or E4D for $125,000, for a total price of $275,000. The Section 179 deduction ($250,000) coupled with standard depreciation would mean the 2009 depreciation is $255,000 as follows:

Assuming you are in the 40% tax bracket, your 2009 tax savings would be:

If you purchase all of the dental equipment as noted above for $275,000 in 2009, your net cost would be $173,000 after the tax savings, computed as follows: $275,000 – $102,000 (tax savings) = $173,000.

The Section 179 Deduction — How does it work for me?

The equipment you purchase during 2009 must be installed and ready for use by Dec. 31, 2009. To the extent your 2009 qualified property purchases exceed $800,000, the $250,000 maximum is reduced dollar–for–dollar. For example, if you purchase $850,000 qualifying property, the $250,000 maximum is reduced by $50,000 to $200,000.

If you are considering building a new office or office facility, consult with your dental CPA. You can find one at www.adcpa.org. If your qualified property purchases exceed $800,000, consider delaying some purchases until 2010. You may also want to chat with your dental CPA about using cost segregation depreciation for the new facility as well. It has tremendous tax benefits associated with it.

Currently as of this writing, the 2010 Section 179 maximum deduction is scheduled to reduce to $125,000, subject to an adjustment for the annual inflation. If the economy continues to perform as it has during 2009, it is likely the $250,000 maximum deduction will be further extended into 2010. Stay tuned!

Do I have to pay for the equipment in full in order to receive the full Section 179 deduction in 2009?

No. Property purchased, whether you pay cash or finance it in 2009 and beyond, qualifies for the Section 179 deduction. Financing can be in the form of a commercial loan or a credit card. As noted above, the property does need to be placed in service by Dec. 31, 2009.

What is the 50% additional first year depreciation?

AFYD allows you to depreciate 50% of the cost of qualifying property acquired in 2009. Used property does not qualify and you cannot “cherry pick” which assets you will use. All assets in a particular useful life class (for example, five–year dental equipment) must be included. This is automatic — you must elect out of it, if you choose not to use it. There is no maximum deduction. The AFYD is set to expire Dec. 31, 2009.

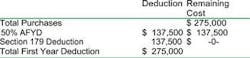

How do the Section 179 deduction and the 50% additional first year depreciation interact?

The 50% AFYD is applied first. Then, Section 179 is applied up to the $250,000 limit on the remaining basis.

Let's use the same assumption as above — total purchase price of $275,000. First, the 50% AFYD is deducted, which is $137,500. Then take Section 179 on the remaining $137,500 cost for a write–off of $275,000 — the entire cost!

Assuming you are in the 40% tax bracket, 2009 tax savings would be as follows:

What other benefits could these tax deductions have on a sole proprietorship, LLC, S Corporation or C Corporation?

If your practice is being taxed as a Sole Proprietorship, LLC, or S Corporation, all of the tax attributes mentioned will pass through to you or the partners/shareholders and reduce your tax liability on your individual income tax return.

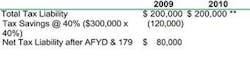

To protect you and your partners/shareholders from a tax penalty, you are required to have the lesser of 90% of your total 2010 federal tax liability, or 110% of your 2009 total federal tax liability, paid by either filed 2009 quarterly estimated tax payments or withholdings on your 2009 W–2. If you do not meet either of these requirements, you will be subject to an Underpayment of Estimated Tax Penalty. Most states have similar requirements, but check with your dental CPA first. In order to illustrate the tax impact for both 2009 and 2010, see the following chart.

Assume your total tax liability for both 2009 and 2010 is $200,000 and you purchase $300,000 of equipment in 2009, taking advantage of both the 2009 AFYD and Section 179 deductions ($150,000 AFYD and $150,000 Section 179).

** To avoid the Underpayment of Estimated Tax Penalty for 2010 you must have paid the lesser of 90% of your total 2010 tax liability ($200,000 x 90% = $180,000) or 110% of your 2009 total tax liability ($80,000 x 110% = $88,000).

Taking advantage of the AFYD and Section 179 deductions will delay the timing of the income tax payments not only in 2009, but also in 2010. The balance of the 2010 income tax liability, $112,000 ($200,000–$88,000), would not be due until April 15, 2011!

Not sure you can get there?

Are you unsure whether you could possibly spend $300,000 for dental equipment? Cone Beam Technology ranges in price from $80,000 to $100,000 for the Gendex CB–500, Kodak #9300, to $175,000 for an i–Cat (Imaging Sciences). CAD–CAM equipment such as the CEREC or E4D can exceed $100,000.

Just these two pieces of equipment approach a cost of $300,000. Dr. Charles Blair, one of the nation's leading dental consultants, addressed the Academy of Dental CPAs at our bi–annual staff training session and informed us that Cone Beam Technology will become the standard of care in the not to distant future.

How do I know how much equipment to purchase?

What will be the impact on my tax liability? Consider meeting with your dental CPA to start running the numbers. There are many factors to be considered, and every situation is different. In fact, your itemized deductions and personal exemptions are impacted by AFYD and Section 179 depreciation.

Itemized deductions and personal exemptions are subject to income–based phase–out. AFYD and Section 179 deductions cause your income to decrease. Thus the phase–outs also decrease and so does your tax liability, all at the same time!

How is your marketing budget impacted as a result of introducing new technology into your practice?

From my own experiences, I've seen a spike in business in each of the dental practices that I represent that invest in the latest dental technology. A weak economy is no excuse for not revamping and retooling your practice. I think you need to consider jump starting your dental practice with the latest technology in order to better serve your patients and create a “buzz” about you in your community.

Working with a dental CPA

Many dentists will be meeting with their dental CPAs during 2009. You may want to meet with your dental equipment vendor to obtain information on equipment specs and prices. As we approach the end of 2009, dentists need to plan ahead.

This allows equipment vendors to provide delivery and installation by Dec. 31, 2009. Begin retooling your dental practice now. If transitioning or selling your dental practice is in your plans, investing in today's technology will preserve and even increase your practice's value.

Consider engaging a dental CPA, who can help minimize your 2009 tax liability and assist with your wealth accumulation. To locate a member of the Academy of Dental CPAs, visit www.adcpa.org, or send me an e–mail to [email protected].

Dental CPAs have in–depth specific training and education on the latest technologies in dentistry and how they interact with the latest tax regulations. Dental CPAs are constantly studying and ensuring that you take full advantage of tax breaks available to you as a dentist. You should become familiar with what a dental CPA can provide you.

Interview dental CPAs and consider engaging one to help you understand the current tax laws and how they impact your practice, employees, and more importantly, your family and future.

Allen M. Schiff, CPA, CFE, is a founding member of the Academy of Dental CPAs, which was established in 2001. The ADCPA is the original, national organization of dental CPAs, consisting of 25 firms that represent more than 7,000 dentists nationwide. To learn more about the ADCPA, visit the organization's Web site at www.adcpa.org, send an e–mail to Schiff at [email protected], or visit his Web site at www.schiffcpa.com.