Thomas Climo, PhD

How should an existing partnership introduce an additional member?

Part I: The Scenario

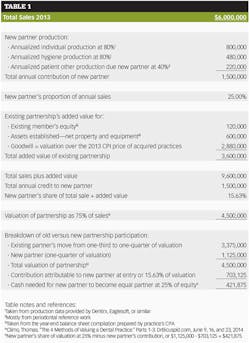

How does an existing partnership introduce an additional member? Let's imagine a dental office with three partners that has employed a fourth dentist for a few years. She has been a valuable addition to the practice, so now they'd like to formally add her as a fourth partner. Table 1 was created to help a partnership committee understand the contribution and consequences of introducing a fourth member into an existing three-member partnership. The partnership owns six dental practices and $6,000,000 in revenue.

Table 1 matches the total sales of all six practices against the dollar contribution of the incoming partner to first calculate the new partner's contribution to total sales, and then match that contribution against an agreed-upon "infrastructure" or added value, or basically what the existing partnership is making available to the new partner. This second calculation reduces the contribution of the new partner from a straight 25% of total sales to one of 15.63% of total sales and added value.

The incoming partner would need to bring in $421,875 to a (conservative) valuation of the six dental practices of $4,500,000. In addition, she would need to equalize the existing members' equity account by bringing in $40,000 (the equivalent of one-third of $120,000). Total cash contribution from the new partner would then be the sum of these two amounts, or $421,875 cash buy-in + $40,000 cash equity payment = $461,875.

$461,875 is a handsome amount of money for someone to come up with, and care would be required to take the new partner on board without killing her financially.

As such, let's say the existing partnership agrees to allow the new partner equal membership on the basis of a seven-year promissory note (at 3% interest) of $461,875 with a down payment of $40,000. Since each of the three partners routinely takes 5.56% of sales as cash withdrawals, the same "take" can be transferred to the proposed member. Table 2 shows how the cash distributions from the partnership provide the proposed partner with a living while she repays her purchase of 25% of the partnership.

Although this schedule is attractive, with a take-home pay for the incoming partner (after repaying the promissory note) of $290,000 in the first year and rising to $440,000 in the seventh year, the schedule underestimates the true value of her becoming a partner.

Part II: Benefits

Inspection of the benefits the partners pay one another over and above the cash withdrawals translates to an annual noncash benefit stream of $50,000 per partner. These are benefits paid out from the cash flow of the six practices for the partnership pension plan, health insurance, and other forms of noncash remuneration. This must be added to the prior bottom line, "Net annual cash to new partner."

The proposed partner has a favorable remuneration and benefit package. Adding in her one-quarter of capital gain in an exit sale assumed at the end of the seventh year-the year of the final payment on the promissory note, or approximately another $2,000,000-the new partner will have invested a nominal sum of $474,531 ($421,875 note with $12,656 of interest and a down payment of $40,000) to recoup nominal dollars of $4,883,663 (see table 4). The ROI is 1,029%. Try making that in the stock market!

However, we have not arrived at the true final solution or calculation of the proposed partner's ROI. There is a missing ingredient.

Part III: Taxation

The new partner may "take home" the money indicated in the tables below and enjoy the benefits her partnership garners, but these dollars and benefits do not entirely fall in her pocket. She has a different kind of partner who shares her income and benefits called the IRS.

The difference between the cash withdrawals subject to income tax and the take-home pay of the new partner is $62,076 per year, the amount pulled from the new partner's income to service the promissory note to buy in to the partnership. Because the down payment, promissory note, and interest on the promissory note are her investment in capital, the $2,000,000 capital gain at the end of the seventh year is captured by a different tax rate (capital gains) than the tax rate (ordinary income) on the take-home income. The difference between treating the buy-in of the partnership through a promissory note with a seventh year capital gain versus taxation every year on the total cash distribution to the new partner is calculated in table 5.

Since the capital gain tax in the seventh year is the same ($289,659) whether the income tax is based on total cash to the new partner or cash to the new partner after debt servicing the promissory note, the net difference to the new partner in the two different tax treatments is an income tax of $152,086 over the seven-year period, or $21,727 annually.

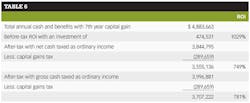

After-tax ROI for these two options are in table 6.

The rub is which after-tax ROI applies-the one in which all income earned in a given year by the incoming partner is subject to a 35% ordinary tax or the one in which a portion of that income is deferred to a later payment (here as year 7) at a lower 20% capital gains tax.

Part IV: Bridge

If the higher after-tax ROI (and extra $21,000 a year) is essential for the incoming partner to meet personal financial obligations, she should instruct the existing partnership that she wants an arrangement whereby she is taxed on ordinary income after debt servicing the promissory note. One thing we can take from tax law is that such a structure, with explicit clauses having to do with deductible expenses, can be created so as to achieve this result. The remaining issue as to whether the existing partnership will accept the consequence of paying ordinary tax on the new partner's debt service payments is another matter. Somebody is paying ordinary tax on income received in the partnership in a given year: the new partner, the existing partnership, or a single member of the existing partnership.

Take note: The only way the partnership can avoid paying ordinary income tax is to have the new partner buy out one of the existing partners so that the payments on the promissory note become a capital gain of the departing partner and not ordinary income of the partnership.

Part V: Conclusion

This article looked at the partnership decision reflecting on the cost of admittance of a new member against the added value of the existing partnership. It also determined the after-tax ROI for the proposed partner. Dependent on which tax basis is applied, there is a fall-off of 248 and 280 percentage points between a before-tax ROI and an after-tax ROI. The difference in the tax consequences of paying for the partnership as a capital investment or in paying for the partnership out of ordinary income creates different income or cash flow streams for the incoming partner, and certainly different ROIs.

Notes

1. Equivalent to the formula; 75% of total sales. Any dentist aware of my position on the economic valuation of dental practices realizes this is not a valuation I support or propose. Rather, it was agreed upon by the three existing partners and one prospective partner.

2. In table 2, a 6% sales growth model was employed, once again at the agreement between partners. The rosy picture emerging in year seven of a half-million gross distribution to each of the four partners created a little concern at the partnership meeting. Follow-up calculations were requested at 3% and 1.5% sales growth. These alternative payback tables, however, are not made part of this article.

3. The $2,000,000 number for the exit is a little exaggerated if we stick with the same method of analysis established so far. $9,021,782 of year 7 sales times 75% equals a sales price of $6,766,336. The sales price of $6,766,336 ÷ 4 partners = $1,691,584 for each partner. For the new partner, her return is based on $1,691,584 less $474,531 (being the down payment, promissory note, and interest), or $1,217,053. Anticipating the next section, a 20% capital gains tax and an additional 3.8% Affordable Care Act tax on investment income generates a tax on the new partner in year 7 of $289,659, leaving a net-of-tax capital gain of $927,394.

4. Ordinary income tax for a dentist can be as low as 28% and as high as 39.6%. There is also a self-employment tax of 15.3% and an additional tax of 0.9% on self-employment income as a result of the ACA. In 2014, capital gains tax legislation created four different layers of tax rates as well as an ACA surtax of 3.8%. See David John Marotta, "Capital Gains Tax Gets More Complicated," Forbes, May 2014.

Thomas A. Climo, PhD, writes and consults on the topic of Dental Economics, specializing in organizing practice management groups for solo practitioners and in the standardization of accounting for and valuation of dental practices. He can be reached at [email protected].