"State of Dental Marketing"

by Lonnie Hirsch and Stewart Gandolf, MBA

For more on this topic, go to www.dentaleconomics.com and search using the following key words: dental marketing, marketing, survey, competitive environment.

Dentists want to grow their practices, but most are operating without a marketing roadmap. “This is an increasingly tough business.” This comment — from an experienced solo dentist (age 55 to 64) practicing in the Midwest — was clear and direct. And many, perhaps most, dentists who participated in the first-ever State of Dental Marketing Survey seem to agree.

But while the need to market their professional services is widely acknowledged, some practices either remain uncomfortable with the idea or don't know what to do.

Commissioned by Dental Economics®, the recent survey was created and conducted in cooperation with Healthcare Success Strategies. Thanks goes out to the dentists throughout the United States who graciously took time from their busy schedules to provide candid and insightful answers to nearly three dozen questions about their marketing activities and attitudes.

Even when interpreted conservatively, the data reveals some intriguing and surprising trends.

"How do dentists feel about marketing?"

Two-thirds of respondents believe that marketing is a "must" in order to survive and thrive.

Dentists who feel marketing is essential to their success "outvoted" those who don't by a landslide. Sixty-four percent of respondents agreed that, "in today's changing and competitive environment, most dentists must actively market themselves to survive and thrive." About 19% "disagreed," and the rest said they were "not sure." (See Fig. 1.)

Of course, while most respondents felt marketing is necessary, that doesn't necessarily mean they have to like it. So we dug a little further to see how dentists feel about marketing. The result …

While 72% of respondents said they are "comfortable" with the idea of marketing their practice, a highly vocal 9% said they are not.

Interestingly, many of the "uncomfortable" dentists were effusive in the general comments section. For example, one dentist (age 55 to 64) feels that: "Dentistry is overmarketed … and negative for [a dentist's] reputation." This practice also reveals that it does not have a marketing plan, and that they are achieving "no growth." Another practice (someone 35 to 44) said: "I find many advertisements cheap and cheesy … and [some dentists] seem to be begging for patients." And another (age not provided) wrote: "I have a concern about the ethics of dental advertising. I am 'old fashioned' in the belief that professionals should not advertise."

As you might expect, larger practices were more open to marketing, but the real differences were apparent in the comments section.

A growing practice (one dentist with multiple locations; over $1 million in revenue) believes: "Marketing is essential [to] cosmetic dentists to not only promote the practice and services, but to create competitive differentiation. Internet marketing is my No. 1 referral source." And from another: "[The practice is] less than one year old with gross exceeding $1 million." (Dental group; Southern state.)

However, there were some surprises too. For example, a sizeable number of the respondents who said they were not comfortable with marketing also said they felt that marketing is essential.

Also, while we would have expected younger doctors to be more open to marketing, we did not see a statistically significant correlation. Still, while dentistry has been glacial in its acceptance of marketing (it has been legal for 30 years now), we expect acceptance of marketing to continue as the old guard retires and younger, hungrier dentists take their place.

"What do dentists want?"

Seventy-one percent of respondents said they"d like to attract more patients

Many of the dentists we've worked with over the years have told us they want more patients, while others have told us they much prefer better cases. We couldn't wait to see which opinion would be more popular. While the majority of dentists said they would like both, more dentists said they would like more patients (71%) than those who indicated they'd like better cases (62%).

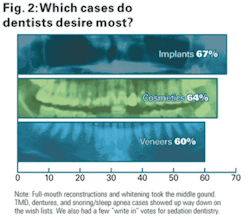

Implant cases top the list of preferred cases.

We designed the survey so we could find out which cases dentists desire most. While we shouldn't have been, we were a little surprised that implants (67%) have finally edged out cosmetics (64%) and veneers (60%) as the most sought after cases. Full-mouth reconstructions and whitening took the middle ground. TMD, dentures, and snoring/sleep apnea cases showed up way down on the wish lists. We also had a few "write in" votes for sedation dentistry. (See Fig. 2.)

Two-thirds of dentists would like to increase their practice revenues and profits.

We found that respondents had fairly aggressive revenue growth goals for the next 12 months. Sixty-one percent said they'd like to increase revenues by at least 25% or more, and about half of those (32% overall) said they would like to increase their revenues by 50% or more.

We found that profit goals were similarly aggressive. Sixty-nine percent would like to increase their profits by at least 25% over the next 12 months, while 30% of respondents said they'd like to grow profits by 50% or more.

While younger dentists were slightly more ambitious in their revenue goals, the skew was far less significant than you might think. Of those looking for 50% or better profit growth over the next year, 39% were over the age of 45. What's more, practices grossing more than $1 million were more aggressive in their profit growth goals than their smaller counterparts.

Intangibles rank high on the wish list.

While most dentists were interested in increasing their patients, revenues and profits, many dentists also desire intangible goals. For example:

- 53% of respondents said they'd like to enhance their professional reputations.

- 51% said they'd like to take more time off work to spend with family and other interests.

- 45% would like to spend more of their time on cases they enjoy or take advantage of their specialized expertise.

- 34% would like to reduce their reliance on low-paying insurances.

- 35% would like to build the practice up to sell it.

- 36% said they'd like to be a recognized leader in their field.

- 39% said they'd like the practice to support charitable causes.

"How do dentists rate their own marketing efforts?"

Only 8% of respondents rated their markeing program as "highly effective."

Wow, that's pretty low, and the story goes downhill from there. Forty-four percent said their marketing program was only somewhat effective, 18% said it was not effective (no measurable results), and fully 30% said they have no marketing program at all. That's scary when you consider the overwhelming majority of dentists have aggressive growth goals.

Few practices have a written marketing plan, but successful practices always do.

Unfortunately, most practices (over 80%) say they do not have a written marketing plan to reach their goals.

Perhaps not surprisingly very few practices without a plan feel their marketing program is "highly effective"; more than 50% report inconsistent or not effective results.

Conversely, 100% of survey practices with revenue in the $1 to $3 million range all have a marketing plan and are experiencing an upward financial trend. The majority of practices with a plan have set (and appear to be meeting) stronger growth goals, feel less impacted by competition, and report attracting 30 or more new patients per office monthly.

Marketing is a mystery for some practices.

New practices, as well as established dentists who are new to marketing, are uncertain about what to do. Typically, one dentist (age 45 to 54) admits that: "Marketing is a new paradigm for me and my knowledge in how to use it effectively is paralyzing me from doing anything." Although open to marketing, this practice has no plan; relies mainly on "word-of-mouth"; and reports a "flat" revenue stream with no significant change from year to year.

Vital tracking is lacking.

Over 50% of practices don't reliably monitor and evaluate the results of their marketing, advertising, or promotional efforts. Only a few (3%) use an online call tracking system, while some say they try, but are inconsistent or irregular (36.5%). Still others (21.3%) are totally in the dark, saying they don't have time or simply don't know what's working.

Sources of marketing help and advice.

Dentists give top credit to Dental Economics® as their primary resource (69.4%) for marketing help and advice — far above all other resources. But at the other end of the spectrum, the survey reveals that "other dentists," and "friends, neighbors, and acquaintances" are also frequently tapped as resources for dentists.

Observation: While we don't know of a more authoritative publication than Dental Economics®, we can't help having concern about the marketing qualifications of "friends, neighbors, and acquaintances."

"Which marketing strategies do dentists prefer?"

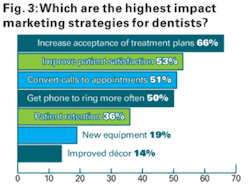

Case acceptance was the No. 1 "High-impact" opportunity to improve the bottom line

We asked respondents to rate 11 primary dental marketing strategies (not tactics) from "high impact" to "low impact." The highest impact strategies were: Increase acceptance of our treatment plans (66%), improve patient satisfaction (53%), improve the staff's ability to convert inquiries to phone appointments (51%), get the phone to ring more often (50%), and keep patients from leaving the practice (36%). Improved décor (14%) and new equipment purchases (19%) brought up the rear. (See Fig. 3.)

Internal marketing feels better and "safer."

Eighty percent of participants felt that getting the phone to ring more often would help their profitability, so the next logical question is how?

Overall, dentists still report their best results with traditional internal marketing tactics include asking patients for referrals and patient recall systems.

Because internal marketing is the only marketing most dentists feel comfortable with, we must be careful to not overinterpret those results. Up to 81% of respondents said newspapers, radio, publicity, coupons, signs, and television are "not applicable."

Internet marketing is an opportunity for many.

Seven percent of respondents felt their Web site was extremely effective at generating patients, 29% felt it was somewhat effective, 29% said it doesn't directly generate patients, and 35% of respondents said the question was not applicable (most of these probably do not have a Web site).

Relatively few dentists reported attempts at search engine optimization, e-mail marketing, or pay-per-click advertising, though 2% to 5% of respondents reported these to be "highly effective."

Observation: Internet marketing remains a huge opportunity for many practices, but this window will close as more and more dentists jump into the game.

Yellow Pages story is mixed.

Despite the Internet age, the medium that dentists love to hate is not quite dead. Six percent ranked Yellow Pages as highly effective, 26% ranked it as somewhat effective, 20% said it felt good but doesn't directly generate patients, 26% said it was not at all effective, and 21% called it not applicable. A word of caution — many of the dentists who said the Yellow Pages is not effective may have a simple line listing instead of an ad.

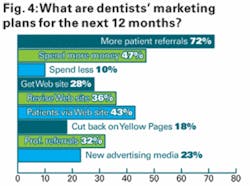

"What will dentists do in coming months?"

When we asked dentists about their marketing plans for the next 12 months, 72% said they'd try harder to get more patient referrals (promises, promises), 47% said they'd spend more money, 10% said they'd spend less, 28% said they'd get a Web site, 36% said they'd revise their Web site, 43% said they'd attempt to get more patients from their Web site, 18% said they'd cut back on Yellow Pages, 32% will focus more energy on professional referrals (e.g., from medical doctors and dentists), and 23% said they would try new advertising media. (See Fig. 4.)

Survey participants profile … More than 81% of survey participants characterize themselves as a "General/Cosmetic Dentist," including young and old, women and men. Nearly 70% are solo practitioners with one office location.

On average, most dental practices are seeing between 11 and 20 new patients per office per month. But a few practices (about 10%) reported as few as zero to four new patients, while another 10% at the top of the scale see more than 50 new patients per month.

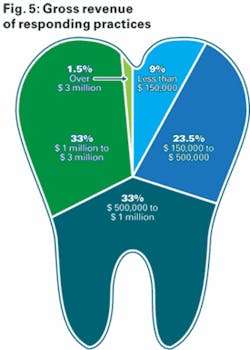

About one-third of responding practices report an annual gross revenue between $500,000 and $1 million, and another third say revenues are between $1 and $3 million. Only 1.5% say the practice generates over $3 million, but nearly 9% say annual revenues are less than $150,000. (See Fig. 5.)

What we didn't find … Overall, responses to the survey were largely gender-neutral, although survey participants were mostly male (83%). Responses also tended to be age-neutral. Although participants ranged from 25 to 75 years in age, except as previously noted, significant distinctions were generally not observed in considering answers by age category.

With our thanks … Dental practices that participated in the survey will receive, in addition to our thanks, a special report from Dental Economics® and Healthcare Success Strategies that provides detailed results from the survey. We appreciate your help in making the study possible, and we hope that the in-depth survey data will help make your dental marketing more effective.

Stewart Gandolf, MBA, and Lonnie Hirsch are cofounders of Healthcare Success Strategies, and two of America's most experienced practice marketers. They have worked with dentists for a combined 30 years, have written numerous articles on practice marketing, and have consulted with more than 3,000 private health-care practices. Reach them by calling (888) 679-0050, through their Web site at www.healthcaresuccess.com/dental, or via e-mail at [email protected].