Allowing more employees to participate in your retirement plan may benefit you

By John K. McGill, CPA, JD, MBA, and Jason Arnold, QKA

One of the most common questions asked by doctors is, “How can I increase my retirement plan contributions without significantly increasing staff costs?” Although it may sound counterintuitive, at times the answer may be to expand retirement benefits to employees who are ineligible to participate, due to minimum service or age requirements defined in the retirement plan document.

Allowing ineligible employees to participate in the retirement plan can be accomplished by amending the retirement plan document with a provision to “waive” the eligibility requirements for any employees who are employed on a specific date, or by altering the eligibility requirements for employees in future years. If ineligible employees are younger than the owners, the younger employees may have a very positive impact on the nondiscrimination testing of the retirement plan.

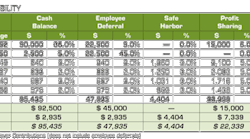

The tables illustrate how allowing more employees to participate in the plan can provide an opportunity for doctors to dramatically increase their annual retirement plan contribution with minimal increases to staff costs. Table 1 is based on a doctor with traditional eligibility requirements of 12 months, 1,000 hours, and a minimum age of 21. Under this scenario, only the doctor, spouse, and four employees are eligible for retirement plan benefits. Based on these eligible participants and the nondiscrimination testing, the owners receive a total contribution allocation of $152,500, or 91.2% of the total contribution of $167,178. The staff would receive the remaining contribution allocation of $14,678, or 8.8% of the total contribution.

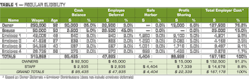

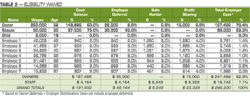

Table 2 is based on the same doctor that waives the eligibility requirement for an employee that was employed on the first day of the plan year, regardless of his or her age or service. The result of waiving eligibility is that the four previously ineligible employees (three employees and the owner’s child) are allowed to enter the plan. While there is an additional expense of providing contributions for three employees that were previously ineligible, the benefits substantially outweigh the costs.

The owners are able to increase their previous contribution allocation of $152,500 to a contribution allocation of $247,488, or 92.9% of the total contribution of $266,230. The increase in the contribution for the owners is $94,988, while the contribution for the staff increases only by $4,064. As a result, the doctor increases the total contribution by $99,052, and the doctor receives 95.9% of the increase. Additionally, the doctor will save over $39,000 in income taxes (assuming a combined 40% tax bracket for federal and state income taxes).

While providing retirement plan benefits to the least number of employees is very common and can be extremely cost effective, it may not always be the best option. Doctors with young employees who are not eligible to participate in the retirement plan may benefit from including the previously ineligible employees in the retirement plan. The tables illustrate that the increase in contributions and tax savings can be extremely significant. As a result, doctors should consult with their third-party retirement plan administrator every year to ensure they maximize their contributions, minimize staff costs, and do not overpay their income taxes. Additionally, doctors should consider the substantial federal and state income tax savings afforded by funding retirement plans at this higher level as a source of cash to fund the plan.

John McGill provides tax and business planning exclusively for the dental profession, and publishes the McGill Advisory newsletter through John K. McGill & Company, Inc., a member of the McGill & Hill Group, LLC. Jason Arnold provides retirement plan design and administration services through PenSys, Inc., an affiliate of the McGill & Hill Group, a one-stop resource for tax and business planning, practice transition, legal, retirement plan administration, CPA, and investment advisory services. Visit www.mcgillhillgroup.com for more information.

Past DE Issues